- Profit Punch

- Posts

- Don't Fear the Cool Off

Don't Fear the Cool Off

4 Breakout setups that ignore the S&P 500.

📰 In This Issue…

If you want the biggest gains, you don't chase what already ran—you position yourself where the money is going.

The "Easy Money" has rotated. The momentum is shifting from over-extended tech stocks into Real Assets and Recovery Plays. Currently, the 5 strongest industries on our radar are:

Gold & Silver (Inflation hedge)

Electronic Components (AI Hardware)

Semiconductors (AI )

Commodities (Aluminum, Copper, Uranium)

Inside this edition:

The Headliner: $SES ( ▲ 4.12% ) —The AI battery play that is finally ready to move.

The "Miner to AI" Pivot: Why Crypto miners are the new Data Center powerhouses.

🔒 Premium Only: The "Fallen Angels" (IPOs & Real Estate) that are forming massive bases and waking up.

Most opportunities right now are Swing Trades. Long-term investors: Sit on your hands and wait for the fat pitch.

🏆 Top Setup of the Day

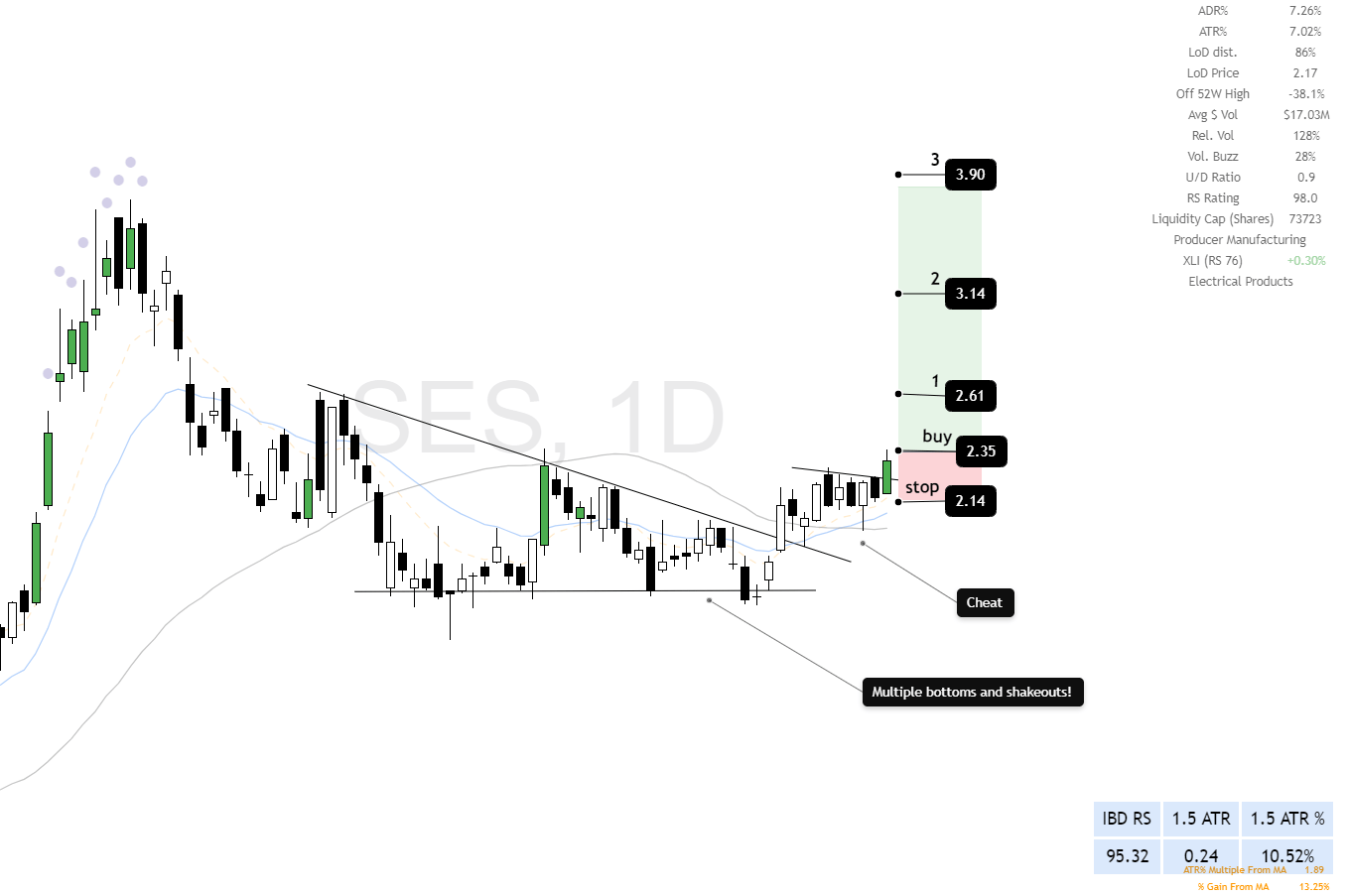

$SES ( ▲ 4.12% ) - Swing trade

The Context: SES AI is a leader in high-performance Li-Metal batteries for EVs and urban air mobility (drones). They are heavily backed by major automakers (GM, Hyundai) and are using AI to solve the "safety vs. density" battery problem.

Why it matters: This is a high-beta speculation on the future of energy storage.

The Setup: The stock has been beaten down but is showing signs of a reversal.

Strategy: Swing Trade only. Volatility is high, so keep your stops respected.

SES AI

🔒 Below are the Rest of the Market Leaders (Upgrade to Premium to Unlock the Rest of the Alerts)

Subscribe to read the rest.

Get the trade alerts, education, and edge our free readers miss.

Already a paying subscriber? Sign In.

Your Premium Subscription Includes:

- • 3–10 curated stock & crypto picks each week

- • Clear Buy/Sell Rules for Maximum Profit

- • Educational breakdowns — learn while you earn

- • 70% refund if you don’t make your money back

- • Full access to our Education Hub — learn while you earn

Reply