- Profit Punch

- Posts

- 💯 Afraid to Start Trading? Use This Trading Strategy for Beginners

💯 Afraid to Start Trading? Use This Trading Strategy for Beginners

Stop letting fear keep you from financial freedom. Here's the exact earnings trading strategy that's helping beginners score massive wins.

This article is from a video on our Youtube Channel.

Are you tired of watching other people make money in the stock market while you sit on the sidelines, paralyzed by fear and uncertainty?

What if I told you there's a beginner-friendly trading strategy that just delivered 96% gains in QUBT in just a few days? Or 125% on QBTS? Or 100% on SEZL in three weeks?

These aren't backtested fantasy trades. These are real recommendations I sent to Profit Punch newsletter members before the moves happened. Real people made real money using this exact system.

The Strategy That's Perfect for Scared Beginners

After years of testing different approaches - from biotech plays to merger arbitrage - I discovered something powerful: earnings gap-up trading.

This strategy is perfect for beginners because:

✅ Clear entry and exit rules (no guesswork)

✅ Defined risk management (you know exactly what you could lose)

✅ Repeatable process (not random gambling)

✅ Big profit potential with small account sizes

Why Earnings Gaps Offer Huge Potential

When I tested this strategy with 30 trades, risking just $30 each, I made $1,000 in profit. That's when I knew this system worked.

Here's why earnings gaps are so powerful:

Companies shock the market. When a company dramatically beats expectations, institutions scramble to buy, creating explosive moves that can last days or weeks.

Surprise = Price Movement. The market hates surprises. When earnings come in 100%+ above expectations, stocks can gap up 7%+ and continue running.

Institutional Money Follows. Once the gap occurs, big money managers need to reposition, creating sustained buying pressure.

The 6 Criteria for Winning Stocks

Not every earnings gap is worth trading. Here's my exact screening criteria:

1. Bullish Market Day

75% of stocks follow the overall market. Don't fight the tide.

2. Bullish Industry

The stock must be in an industry that's trending up. Check the sector ETF - it should be above its 20-day moving average.

3. Strong Catalyst

Either a "super growth stock" or massive earnings surprise (100%+ EPS or revenue surprise).

4. Significant Gap

At least 7% gap up (5% for mega-caps like NVIDIA).

5. Coming From Consolidation

The stock must be "dormant" for 4-6 weeks minimum. No recent big moves.

6. Proper Base Structure

Look for cup-and-handle patterns, double bottoms, or volatility contraction patterns.

Real Trade Breakdowns: How Members Made Bank

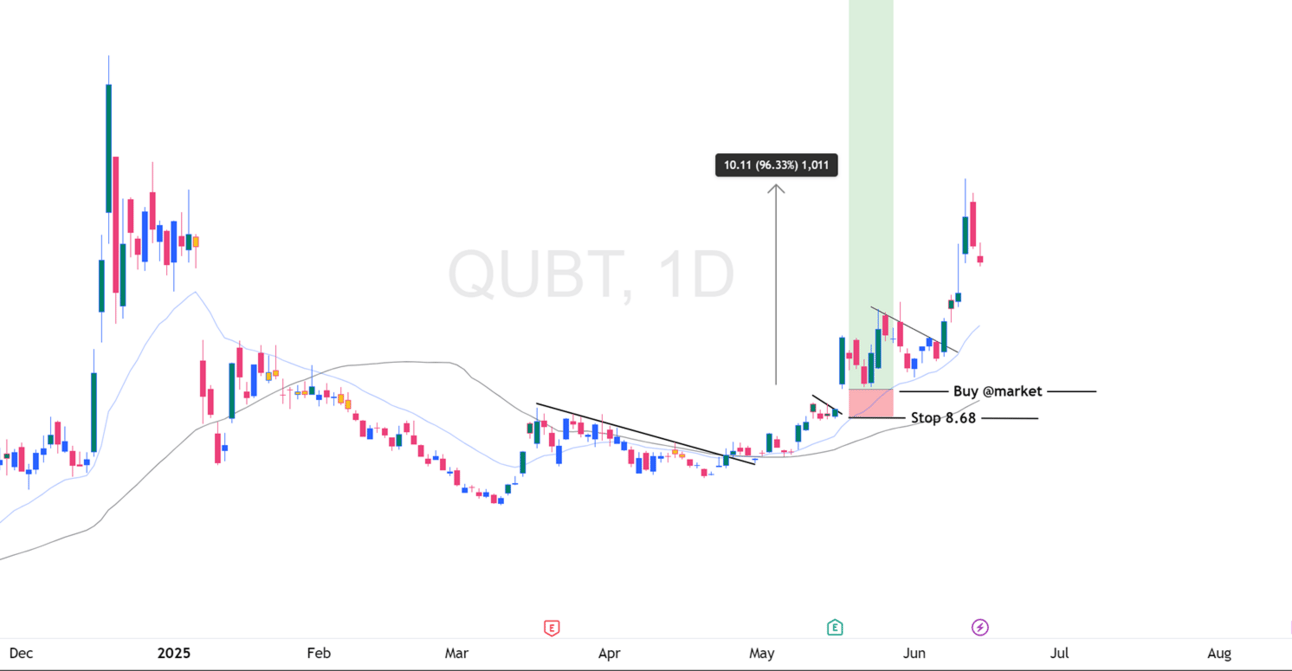

QUBT: 96% in Days

Setup: Quantum computing stock breaking out of cup-and-handle

Industry: Red-hot quantum computing sector

Result: Nearly doubled in less than a week

Strategy: Bought at market open, held using 10-day EMA as guide

QUBT Winner

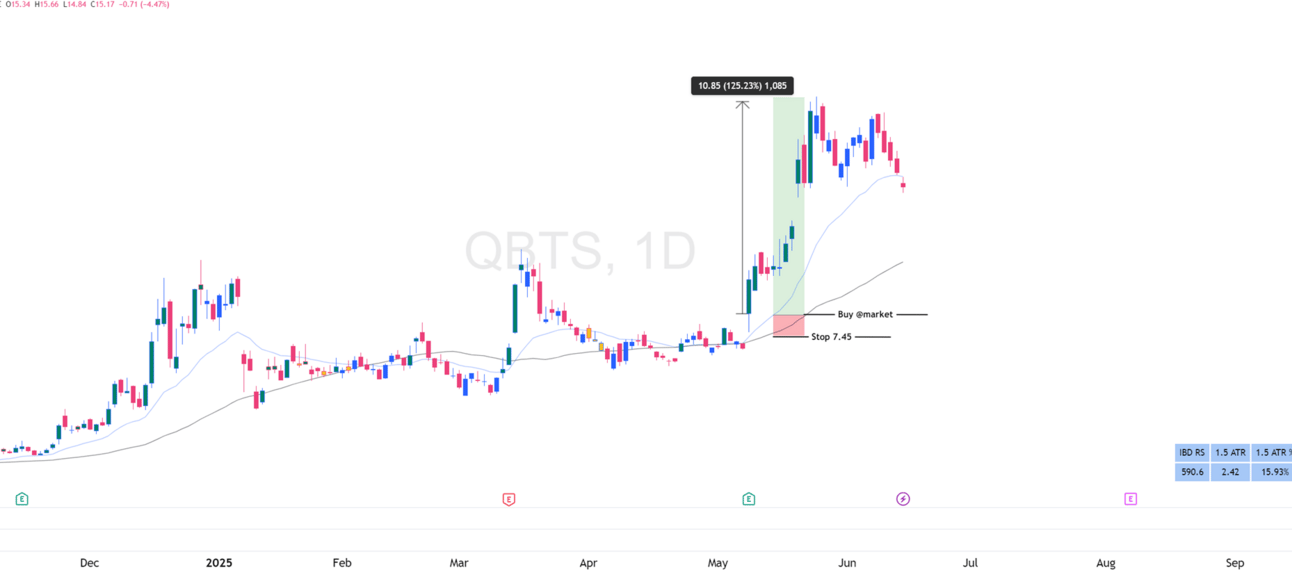

QBTS: 125% Winner

Setup: Volatility contraction pattern after 60% correction

Earnings: 40%+ surprise on both EPS and revenue

Result: 125% gain in days

Risk: Used full 1R stop-loss for smaller company

QBTS Winner

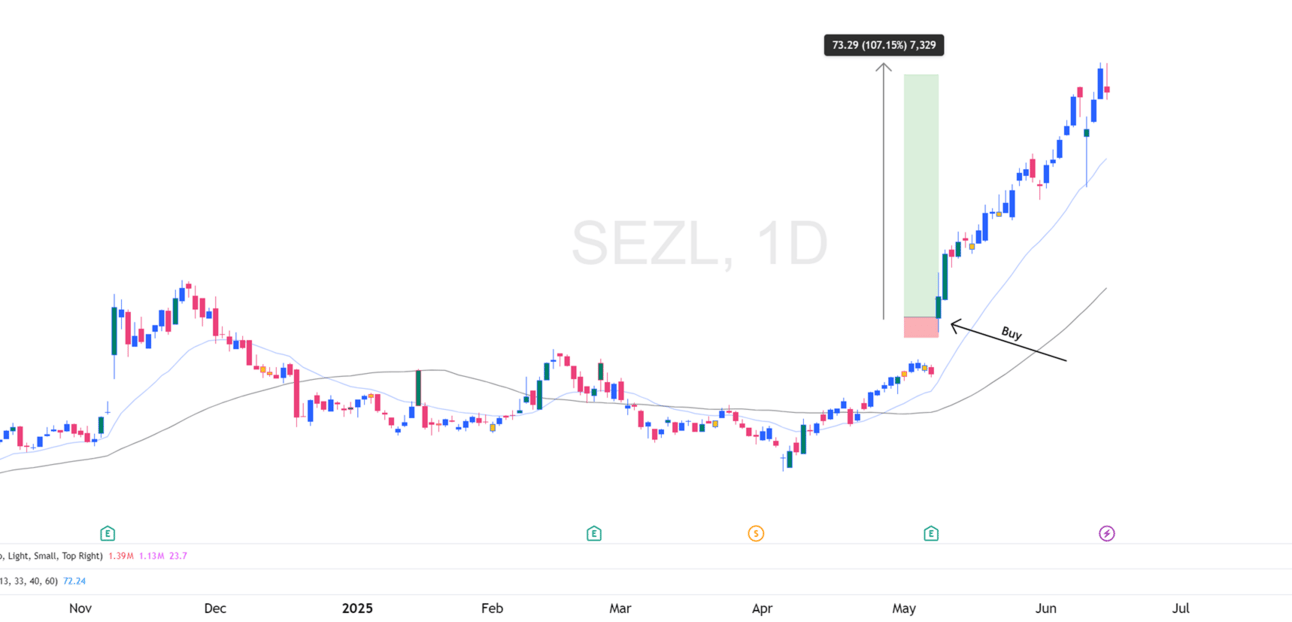

SEZL: 100% in Three Weeks

Setup: 16-week base formation, super growth stock

Market: Coming out of correction (perfect timing)

Result: Clean 100% winner using systematic approach

SEZL Winner

The Risk Management That Protects Your Capital

Making money is nice, but protecting your capital is everything. Here's how I manage risk:

Stop Loss Guidelines:

Large companies: 0.8R stop-loss (R = 1.5x average 14-day range)

Small companies: Full 1R stop-loss

Alternative: 0.7R stop with re-entry capability

Position Sizing:

Risk 0.3-0.5% of account on normal setups

Risk up to 1% on exceptional setups

Never risk more than you can afford to lose

Profit Targets That Maximize Gains

Based on hundreds of studied trades, here are conservative profit projections:

Big Base Breakouts (10+ weeks): 5-7R profit potential

Mid-Move Gaps: 4-5R profit potential

Small Base Breakouts: 3R profit potential

Special Situation Selling (100%+ surprises + big bases):

Sell 30% at 10R profit

Use 10-day EMA as trailing stop for remainder

Some trades can deliver 20R+ (like the 75R winner in ROOT)

The Deadly Mistakes That Kill Profits

Avoid these rookie errors:

❌ Trading stocks without proper base formation

❌ Ignoring market conditions

❌ Trading pre-market or after-hours

❌ Using illiquid stocks (need $30M+ weekly volume)

❌ Giving up after initial weakness (some winners gap up the next day)

How to Find These Plays Every Day

I use TradingView and BarChart scanners to find earnings gaps:

Scan for 7%+ gap-ups in the morning

Check if they reported earnings

Verify the base structure (4-6 week minimum consolidation)

Confirm bullish industry (sector ETF above 20-day MA)

Check earnings surprise (100%+ ideal, 40%+ minimum)

Your Next Step to Trading Success

Look, I could keep teaching you theory all day. But here's the truth: Knowledge without action is worthless.

The difference between successful traders and eternal beginners? Successful traders have a proven system and the confidence to execute it.

That's exactly what I provide in the Profit Punch Premium Newsletter.

✅ Ready-to-trade setups delivered to your inbox

✅ Exact entry and exit points (no guesswork)

✅ Real-time alerts when opportunities appear

✅ Complete strategy guides in our resources hub

✅ Risk management for every trade

✅ Community of successful traders

Our Track Record Speaks:

SMCI: +240% in 3 months

NVDA: +180% in 4 months

HIMS: +60% in 2 weeks

TSLA: +40% short-term winner

Stop Being Afraid. Start Being Profitable.

Every day you wait is another day of missed opportunities. While you're sitting on the sidelines, Profit Punch members are:

Getting exact buy and sell signals

Learning proven patterns that work

Building real wealth in the stock market

Gaining confidence with every successful trade

The slides from this earnings strategy lesson are waiting for you in our premium resources hub. You'll get the complete breakdown, scanners, and tools to implement this immediately.

Questions? Reply to any newsletter email and I'll personally help you get started.

Ready to watch the full strategy breakdown? Check out the complete video here.

Want to start getting these exact trade setups? Upgrade to Premium here.

Reply