- Profit Punch

- Posts

- AI Runs on Power — Here’s Who Profits

AI Runs on Power — Here’s Who Profits

Investment and Swing trade Alerts - Premium Version

🟡 Gold & Utility Stocks Are Heating Up!

Two powerful sectors are showing strength right now — and they’re worth watching (and trading).

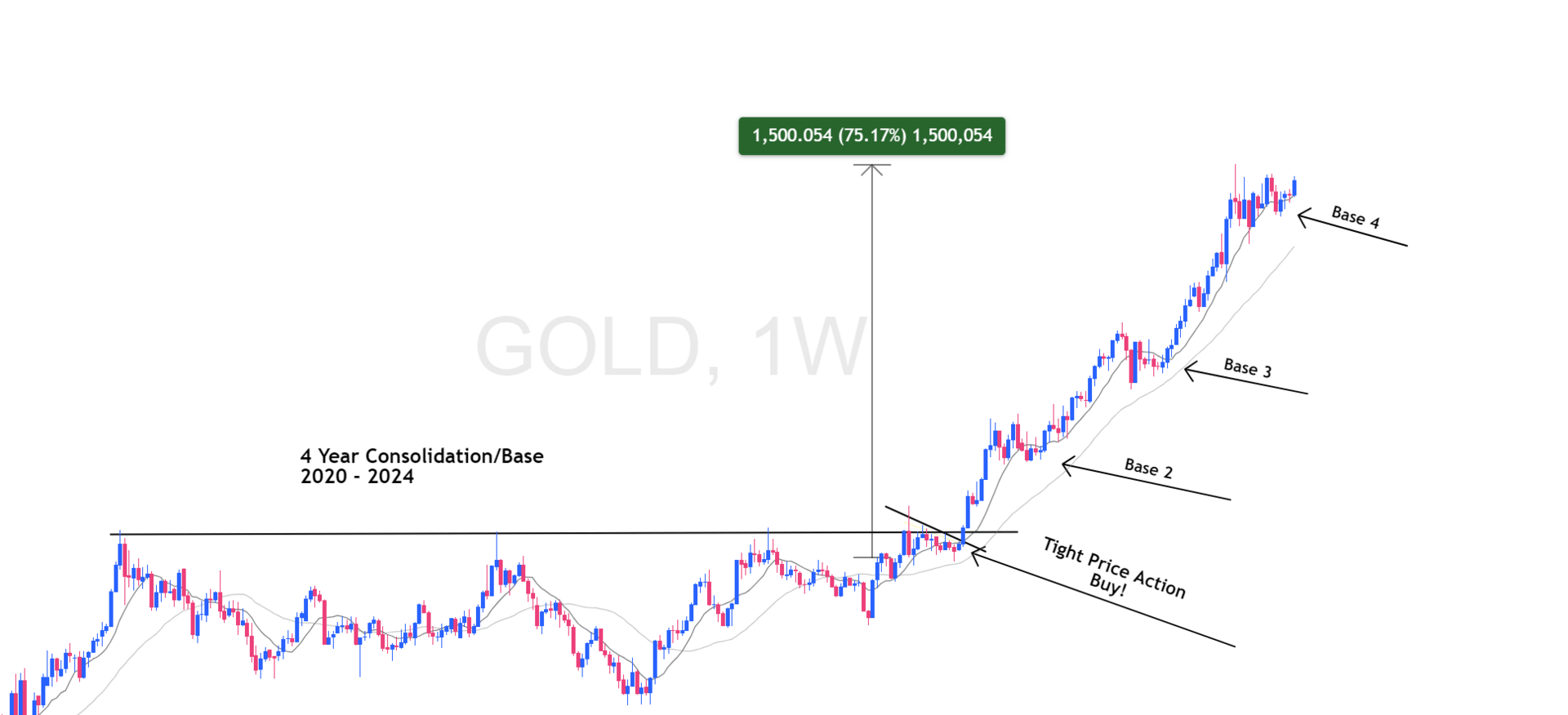

🌟 GOLD: The Commodity King Still Running

Gold has been on a 2-year uptrend and is continuing its strong breakout from early 2024. Interestingly, commodities often end their runs with climactic moves — and we may be approaching that moment.

GOLD Weekly Chart

How to Trade It: Two Paths to Profit

🔹 Gold ETFs — Track gold’s price directly

🔹 Gold Miner Stocks — Leverage gold's move for outsized returns

Gold ETFs

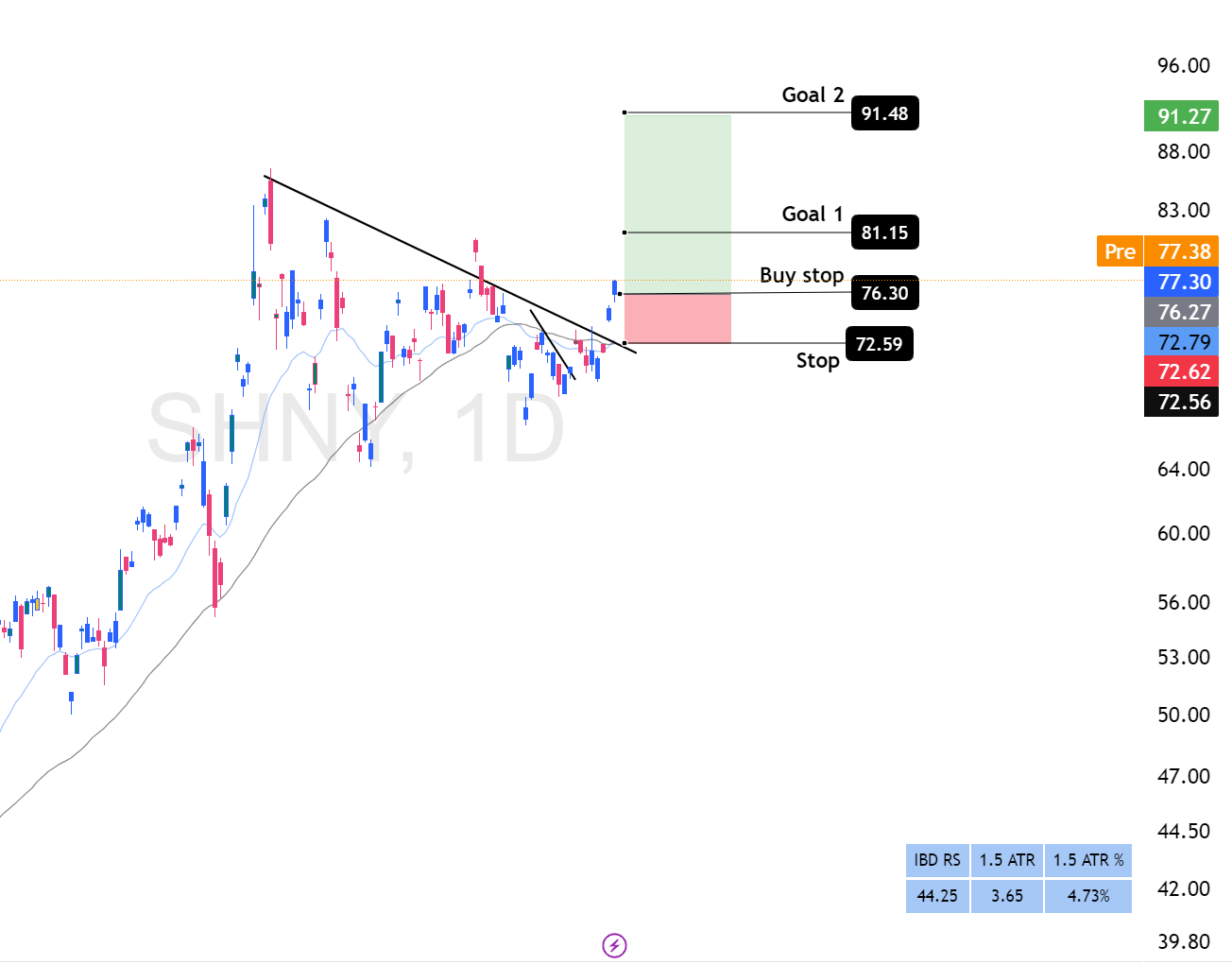

$SHNY ( ▼ 4.14% ) - Long Term Trade

This ETF offers direct exposure to gold’s move — great for those who want to ride the long-term trend.

SHNY ETF Daily Chart

Gold Stocks

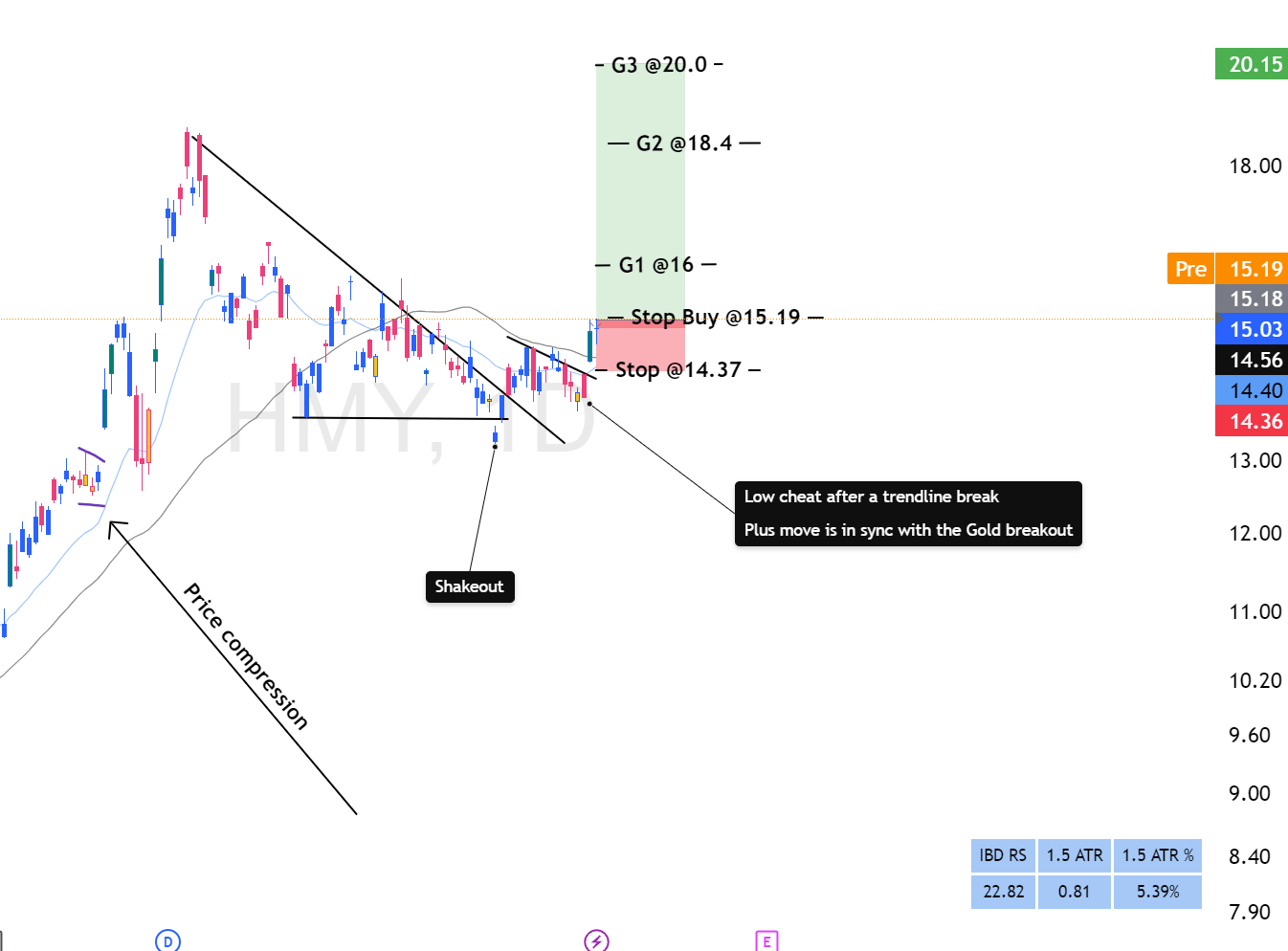

$HMY ( ▼ 1.24% ) - Swing Trade

This stock just pulled back to the 30-Week Moving Average, a level that often acts as a launchpad for another leg up.

HMY Stock

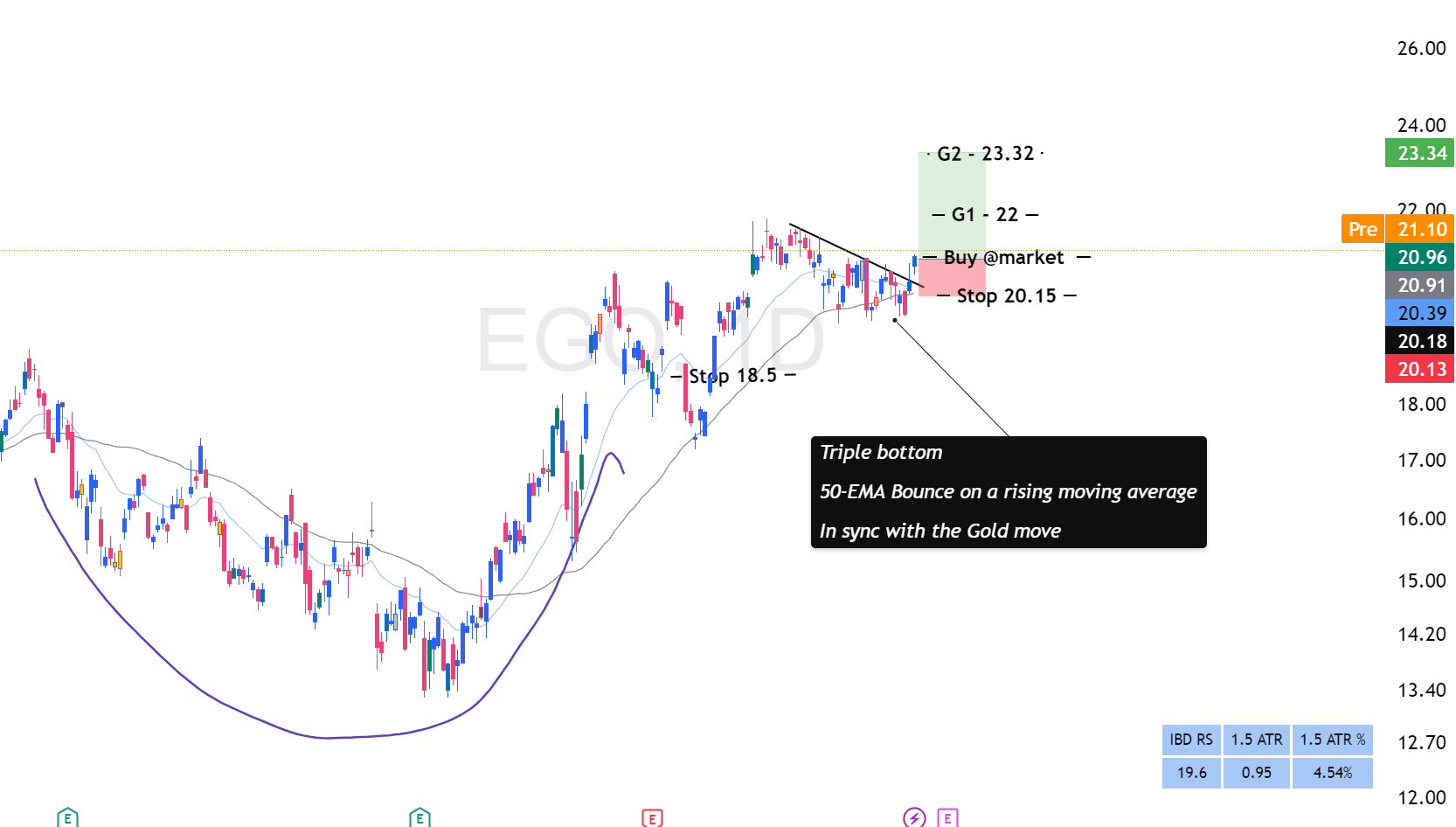

$EGO ( ▼ 1.21% ) - Swing trade

A clean bounce off the rising 50-Day MA makes this a textbook short-term swing setup.

EGO stock

Reply