- Profit Punch

- Posts

- Hottest Stocks on the Market

Hottest Stocks on the Market

Investment and Swing trade Alerts

The goal is to find the strongest sectors and pile into the strongest stocks. I have found strong sectors and you can pick the strongest stocks from these various strong sectors in the market!

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

Entry: Full position on breakout

Profit Taking: Sell 1/4 to 1/5 at Goal 1

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

Entry: Full position on breakout

Profit Taking: Sell 1/3 at Goal 1

Final Exit: Remainder at Goal 2

📊 Crypto

The Bitcoin wave will move Bitcoin ETFs like BITX and also crypto related stocks.

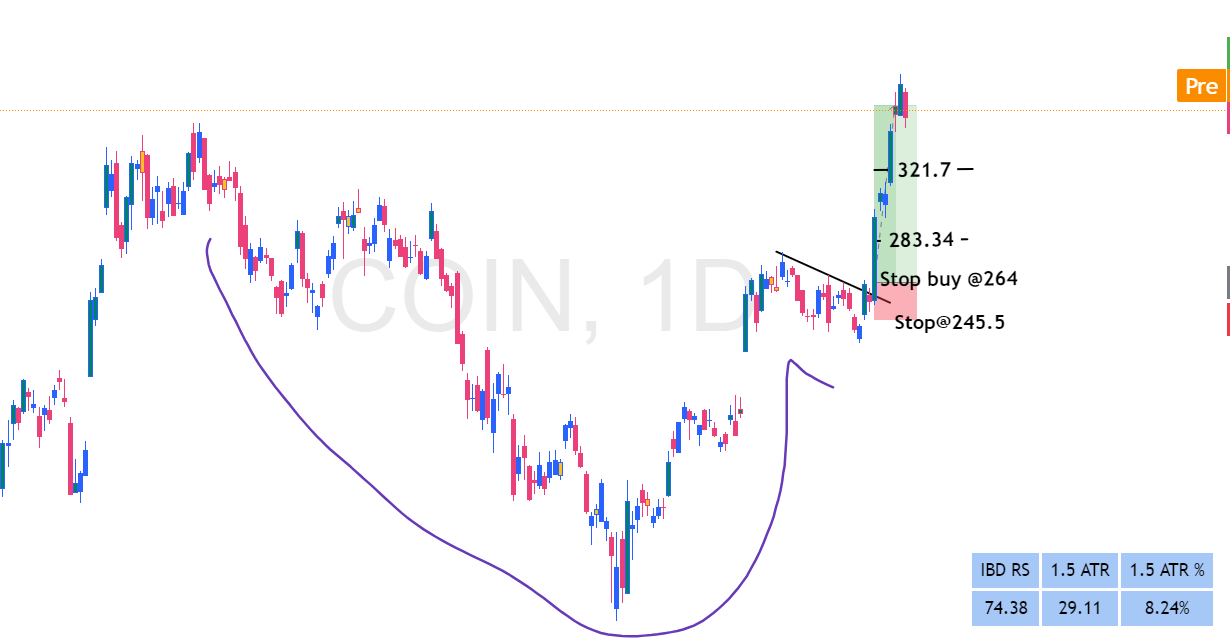

The top stocks are $MSTR ( ▼ 1.66% ) $COIN ( ▼ 1.57% ) and ETFs $BITX ( ▼ 4.92% )

I wouldn’t swing trade this. The short-term price targets are usually much smaller compared to the bigger gains you can get by simply holding.

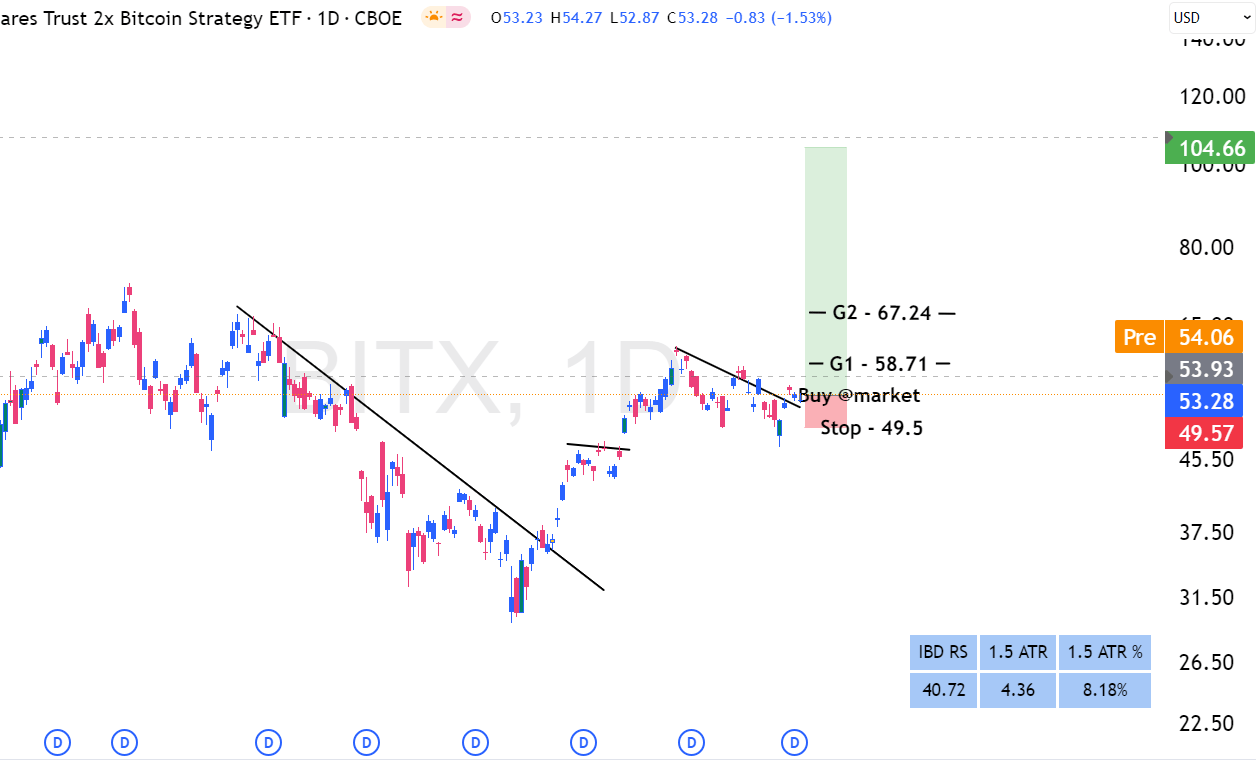

BITX

This is a laggard to $COIN ( ▼ 1.57% ) which is one of the best in the sector. If you missed out on that recommendation then you can hop into this one. Swing traders should be out by G2 and long term traders can hold till G3

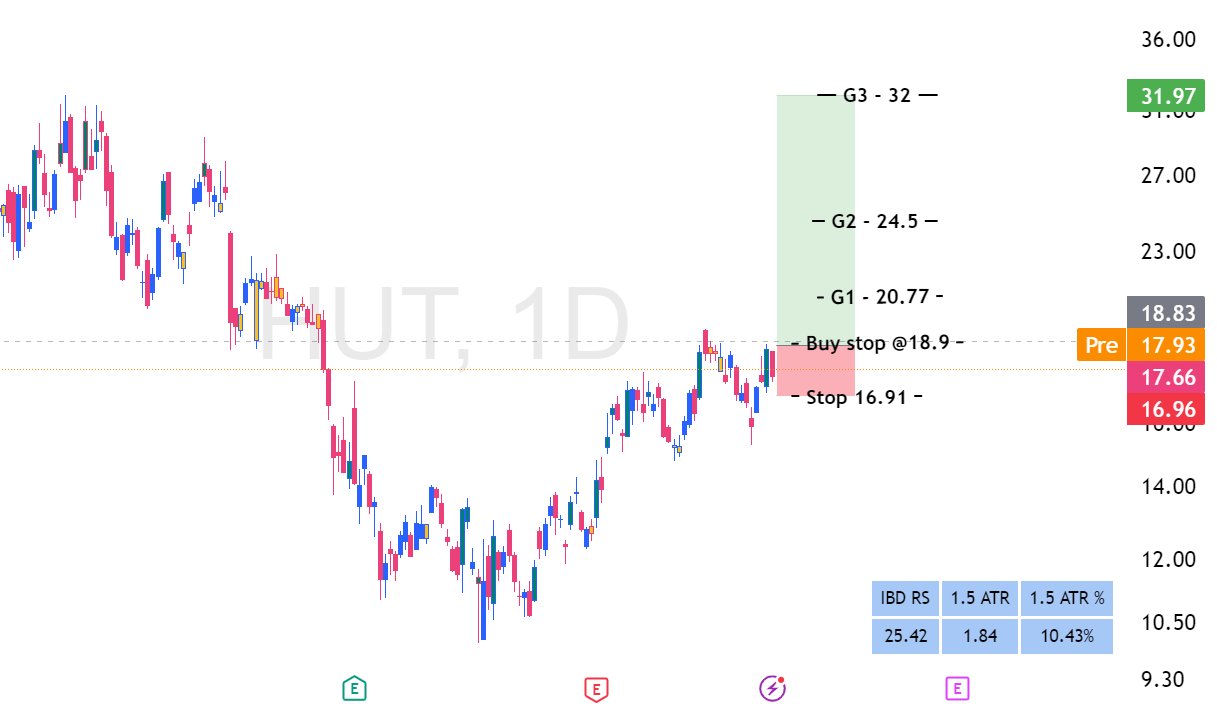

HUT

Our previous recommendation $COIN ( ▼ 1.57% ) hit BIG!! Leaders like this will move first and move the most

Cyclical Sector - Long term Trades

Also one of the strongest stocks on the market. You can swing trade but it is better to hold!

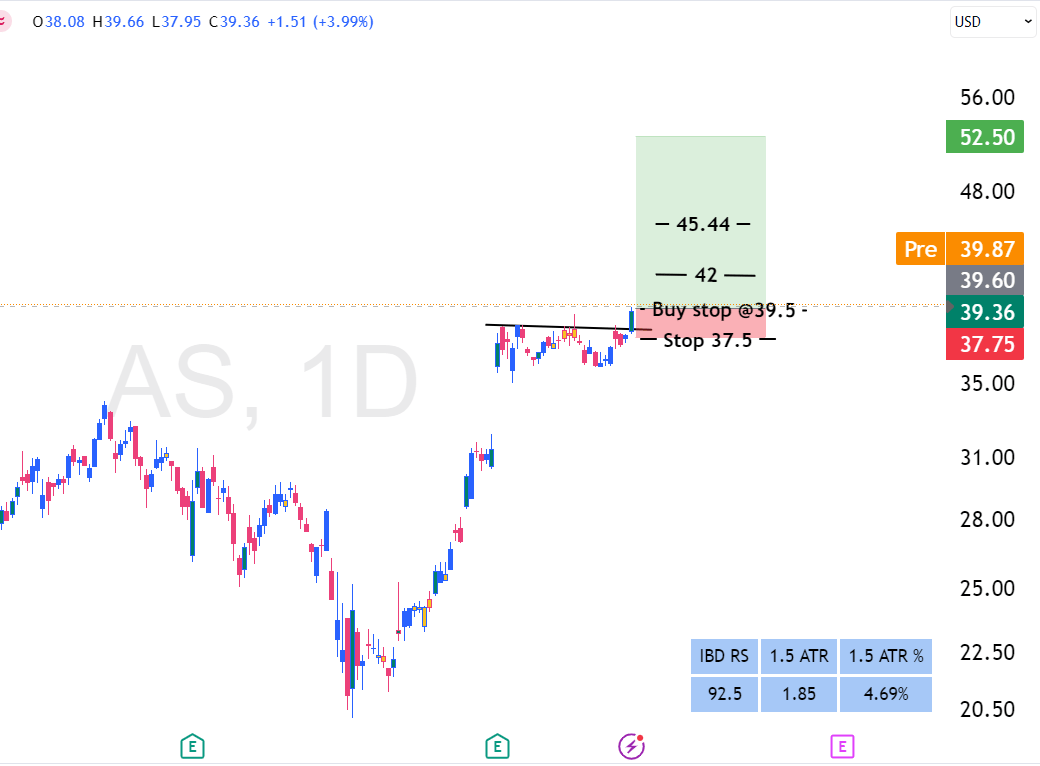

AS

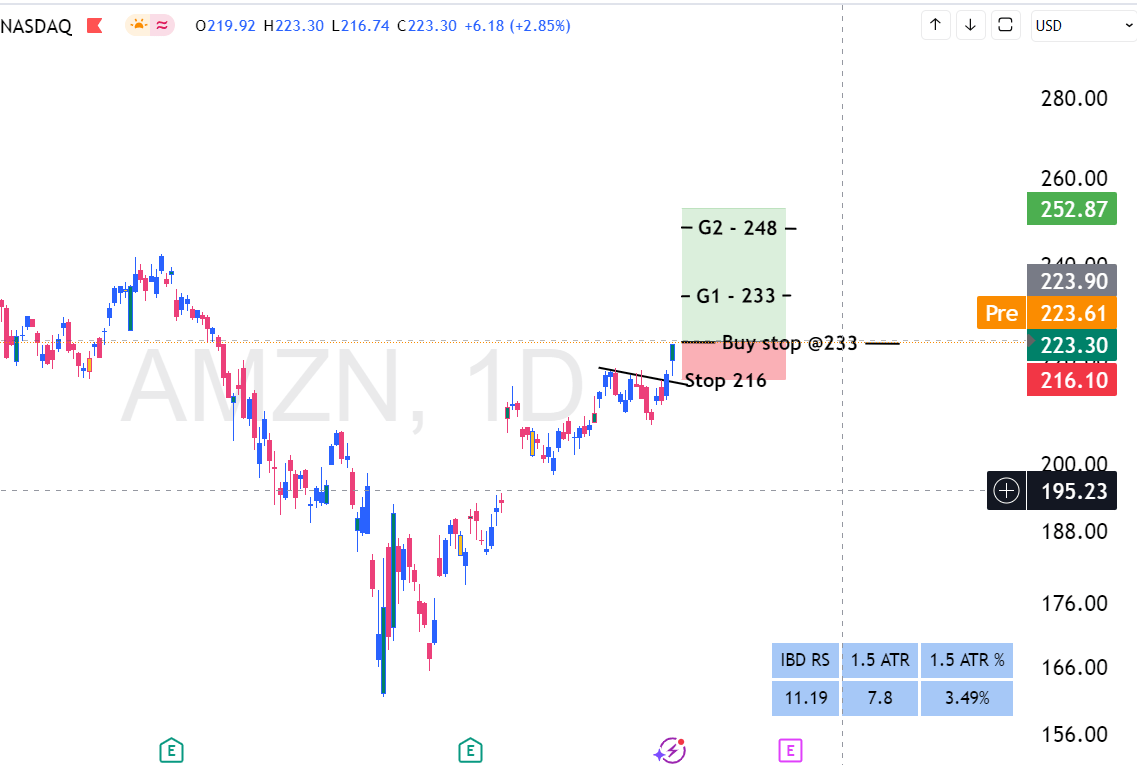

I think we all know this giant. It has created a massive setup. This one does not move above so it is normally a swing trade

AMZN

Financial Sector - Long term Trades

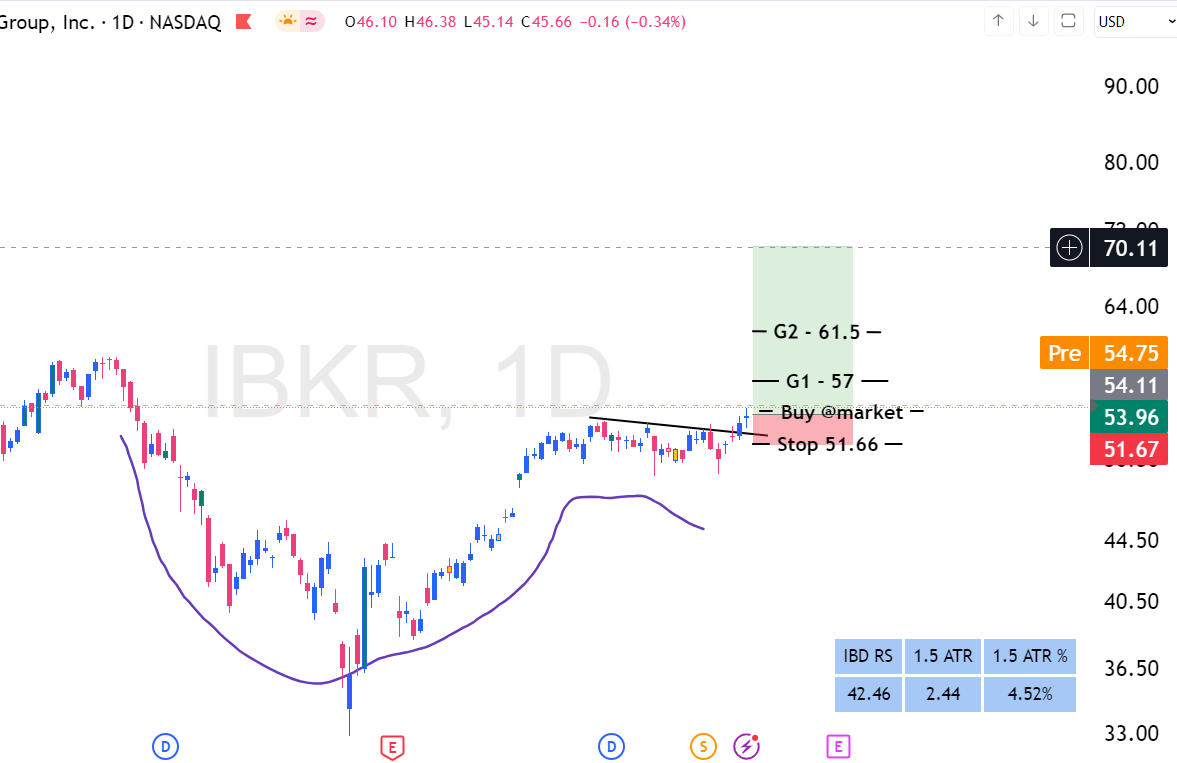

Only enter above the stop-buy level. That means: buy only if the price breaks above the high of the previous day. If it doesn't, it's likely a fake out and not worth the risk.

I wouldn’t swing trade this. The short-term price targets are usually much smaller compared to the bigger gains you can get by simply holding.

IBKR

Special Swing Trade Play

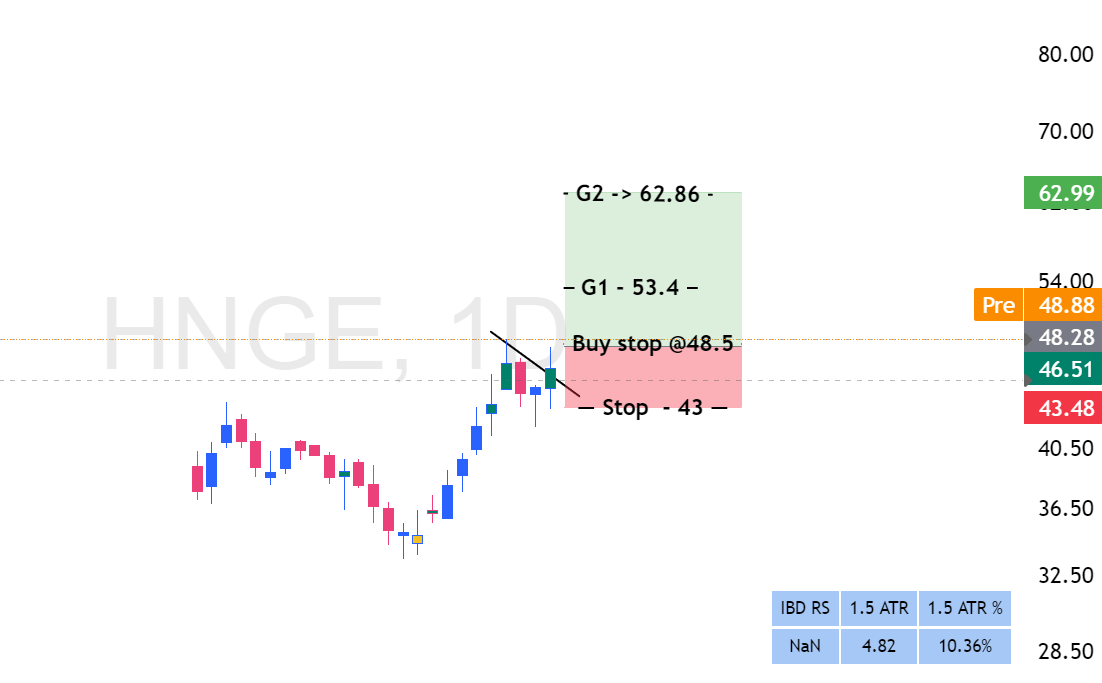

Only enter above the stop-buy level. That means: buy only if the price breaks above the high of the previous day. If it doesn't, it's likely a fake out and not worth the risk.

This is something called an IPO-U Pattern. New stock with strong price action. You may swing trade till goal 2 OR keep holding until it closes under the 20-EMA

These are new stocks with no history! and can create the hugest moves

HNGE

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Long-Term Trade Guidelines |

These apply to investment-style trades, not short-term swings. A detailed version is available on the Resources page, but here’s a quick summary: |

What are we looking for in swing trades: ➖➖➖ Price Structures: Cheats, Double Bottoms, Breakouts, Cup and Handle, Buyable Gap-Ups, Flat/Box Bases, 150MA Bounce, VCP (Virtual Contraction Patterns), Big Bases Breakouts 🔸 Stock Selection: Leaders in strong industries, Stocks showing high relative strength, Companies with strong earnings 🔸 When to enter: Normally after a market correction or bear market! |

Risk Management(Long term trades): ➖➖➖ Risk 0.5%–1.5% of your account per trade. Never risk more than 2% of your total account on a single position. |

Exit Strategy (Simplified from the resources page): ➖➖➖ Conservative / Hands-off: Exit if the price closes below the 50 EMA. Active / Experienced: Exit on a close below the 20 EMA. |

Regards,

Valentine

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. No membership fees.

Connect with primarily self-made, 30-55-year-olds ($5M-$100M net worth) in confidential discussions, peer advisory groups, and live meetups.

Access curated alternative investments like private equity and private credit. With $100M+ invested annually, leverage collective expertise and scale to capture unique opportunities.

Reply