- Profit Punch

- Posts

- How to Turn a 34% Gold Move Into a 170% Winner (The ETF Multiplication Strategy)

How to Turn a 34% Gold Move Into a 170% Winner (The ETF Multiplication Strategy)

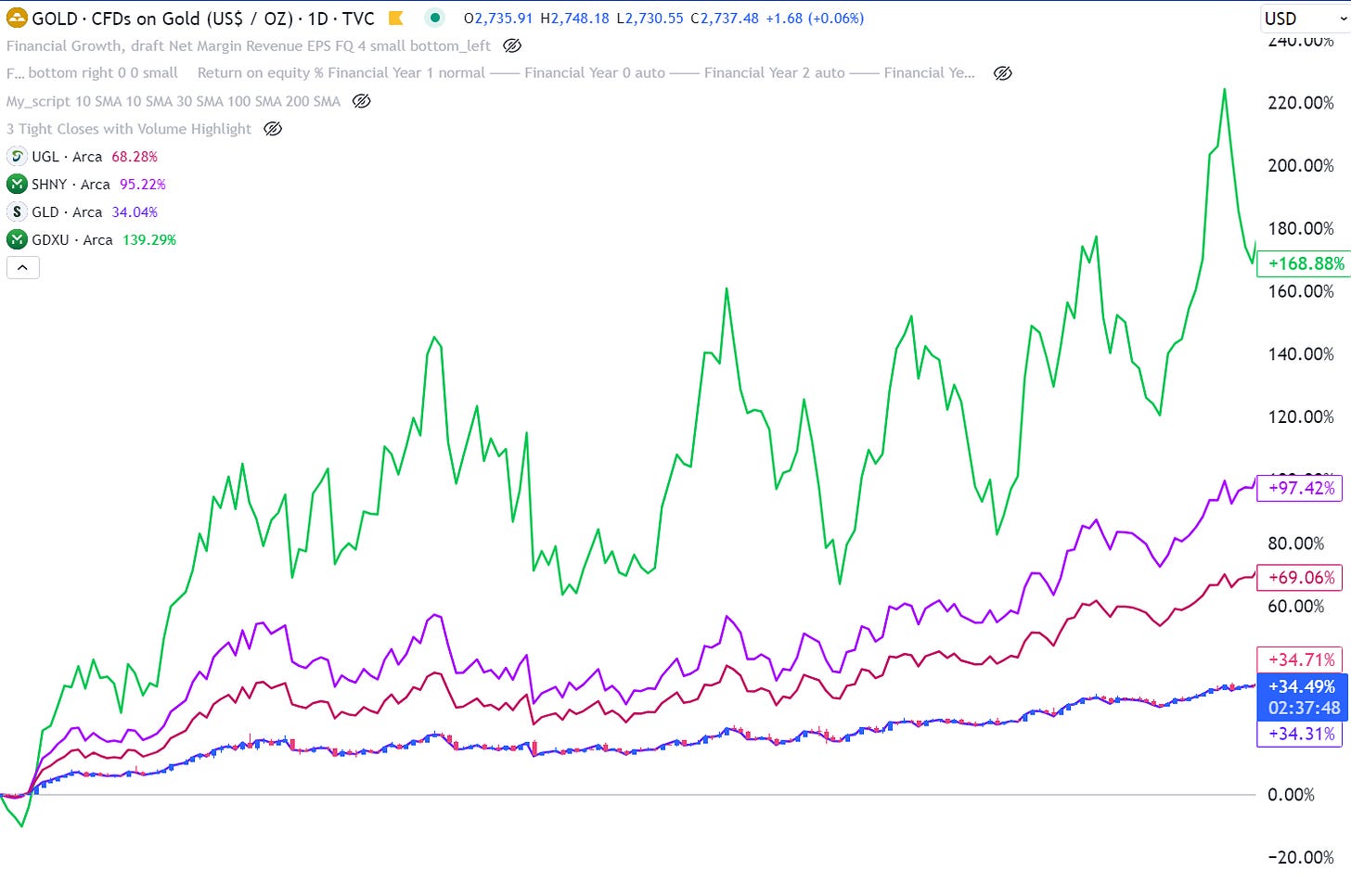

Want to know how gold's recent 34% move turned into a massive 170% profit? It wasn't luck—it was the power of leveraged ETFs. Today, I'm going to show you exactly how to find and trade these powerful tools.

Let me be clear: This isn't just about gold. This strategy works for ANY market in the world. I've used it with oil, tech stocks, and even country ETFs.

Why Most Traders Miss These Opportunities

Look at gold's recent move:

Gold commodity: +34%

Regular gold X1 ETF: +34%

Leveraged ETF X2 : +69%

Leveraged ETF X3 : +97%

Gold miners leveraged ETF X3: +170%

Gold vs UGL (X2 Gold) vs SHNY (X3 Gold) vs GDXU (X3 Gold Miners)

See how the same move multiplied? That's the power of what I'm about to show you.

Step 1: Find Your Base ETF

First, you need to find the regular (1x) ETF. For gold, that's GLD. Here's how I find them:

Go to ETF Database website: https://etfdb.com/

Search your market (gold, oil, tech, etc.)

Filter for good volume (avoid low-volume ETFs)

Pro Tip: Always check the average daily volume. I never trade ETFs with low volume—they're too risky.

Step 2: Leverage Up (Safely)

Here's where it gets interesting. For each market, I look for:

2x leveraged ETF

3x leveraged ETF

Related sector ETFs

For example, with gold:

GLD (1x)

UGL (2x)

SHNY (3x)

GDXU (3x gold miners)

Remember: More leverage = more risk. But here's my secret: I match the leverage to the market's speed.

Step 3: The "Speed Match" Strategy

Here's how I decide which ETF to trade:

Slow Markets (Like Gold):

Moves about 1% per day

Use 3x leverage for better returns

Example: Gold +34% → GDXU +170%

Fast Markets:

Move 2-3% per day

Regular or 2x ETF is enough

Less risk, still great returns

The Complete ETF Arsenal

For each market, build this lineup:

Regular ETF (1x)

Leveraged long (2x or 3x)

Inverse ETF (for confirmation)

Sector-specific ETF

Your Action Plan

Pick ONE market to start (Last months example was gold)

Find its ETF family using ETF Database

Set up your charts (like I showed you last time)

Wait for the setup we'll cover in tomorrow's email

Want to know which ETFs I'm trading right now? Profit Punch members get my exact ETF picks and entry points. [Click here to learn more]

Maybe the markets be with you,

Valentine

Reply