- Profit Punch

- Posts

- Long Term Investment Alert

Long Term Investment Alert

Crypto Plays

Crypto is showing signs of a strong bullish run, and I’m starting to position myself accordingly. While I don’t hold a crypto wallet, I get exposure through stocks and ETFs that mirror crypto performance

🔶 Bitcoin

I've already entered a position at what I call the "low cheat" area and plan to add aggressively on strength — with a tight stop to manage downside risk.

To gain Bitcoin exposure, I use:

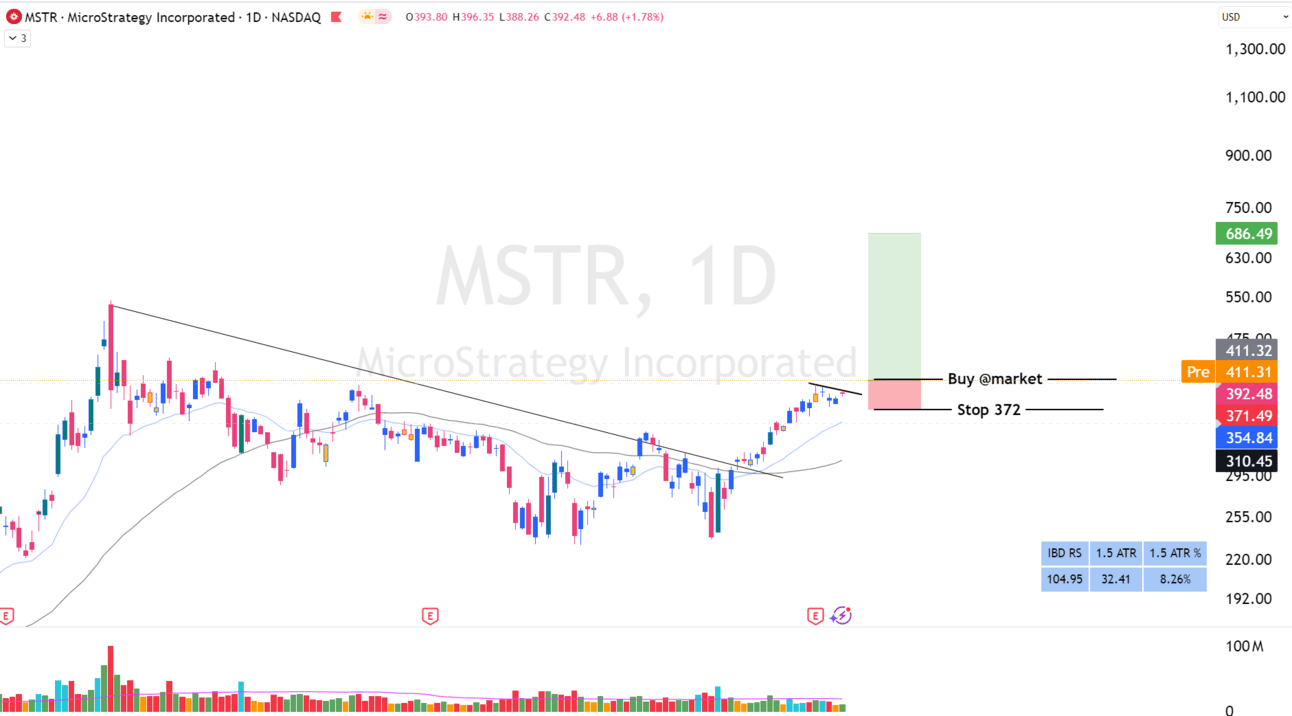

Stock: $MSTR ( ▼ 2.7% )

ETFs: $BITO ( ▼ 2.14% ) and $BITX ( ▼ 4.49% ) (2x leveraged ETF)

🔔 Note: When trading leveraged ETFs like $BITX, I use the 20EMA as a trailing guide. If you wait for the 50MA, much of the profit may already be gone.

Bitcoin Daily Chart

MSTR

$BITX ( ▼ 4.49% ) X2 ETF of Bitcoin

BITX Daily

XRP

XRP is showing a strong signal, but there’s no ETF available for it yet.

I’m not trading this one myself, but wanted to share the setup for those interested.

XRP Daily

🟠 Solana (SOL)

Solana is weak on the weekly chart, so it’s a secondary option for me after Bitcoin. The current pattern isn’t the strongest, but there’s now a new ETF available:

ETF: $SOLZ ( ▼ 4.39% )

Solana Daily

SOLZ Daily

Long-Term Trade Guidelines

These apply to investment-style trades, not short-term swings. A detailed version is available on the Resources page, but here’s a quick summary:

Risk Management(Long term trades): |

Risk 0.5%–1.5% per trade. No more than 2% of your account per trade. |

Exit Strategy: |

Sell at violation of 50EMA You may use (Sell at violation of 20EMA) if you want to be a little more hands on! |

Let me know if you're positioning in crypto too — would love to hear your plays.

Stay sharp,

Valentine

Reply