- Profit Punch

- Posts

- Stop Trading When the Market Looks Like This

Stop Trading When the Market Looks Like This

The 20-day rule that protects your account (and boosts your win rate).

📰 In This Issue…

The market has been in a correction, which means it simply wasn’t the right time to participate.

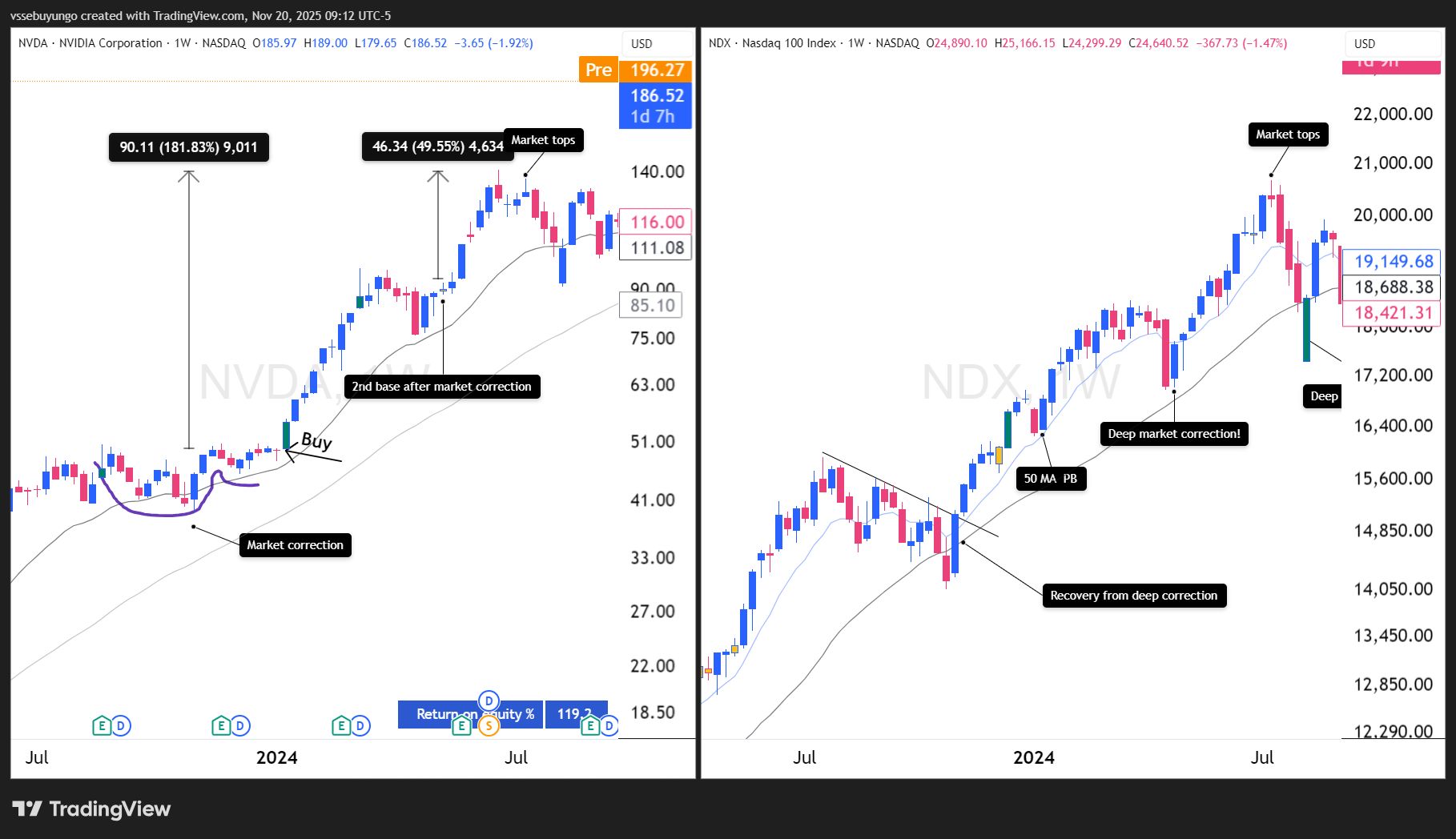

When the market pulls back, most stocks pull back too — and I made this Nvidia vs Nasdaq 100 chart to show how closely they move together.

Nvidia vs Nasdaq 100

I’ll share the full, detailed slides in an upcoming email, but here’s the core idea:

📌 When Should You Trade?

For Long-Term Investors

The two best moments to buy long-term positions are:

After a deep market correction

When the general market pulls back to the 50-day moving average

For Swing Traders

The same rules apply:

After a deep correction

When the market pulls back to the 20–50 day moving averages

🚫 When NOT to Trade

If the general market is under the 20-day moving average, you’ll notice:

9 out of 10 trades fail

Even good setups fall apart

Your account takes unnecessary damage

In these conditions, it’s better to sit out than fight the trend.

📈 Today’s Market Outlook

Today’s issue is mostly swing trades.

Long-term investors should sit tight and wait for those big opportunities that only show up a few times a year.

🏆 Top Setup of the Day

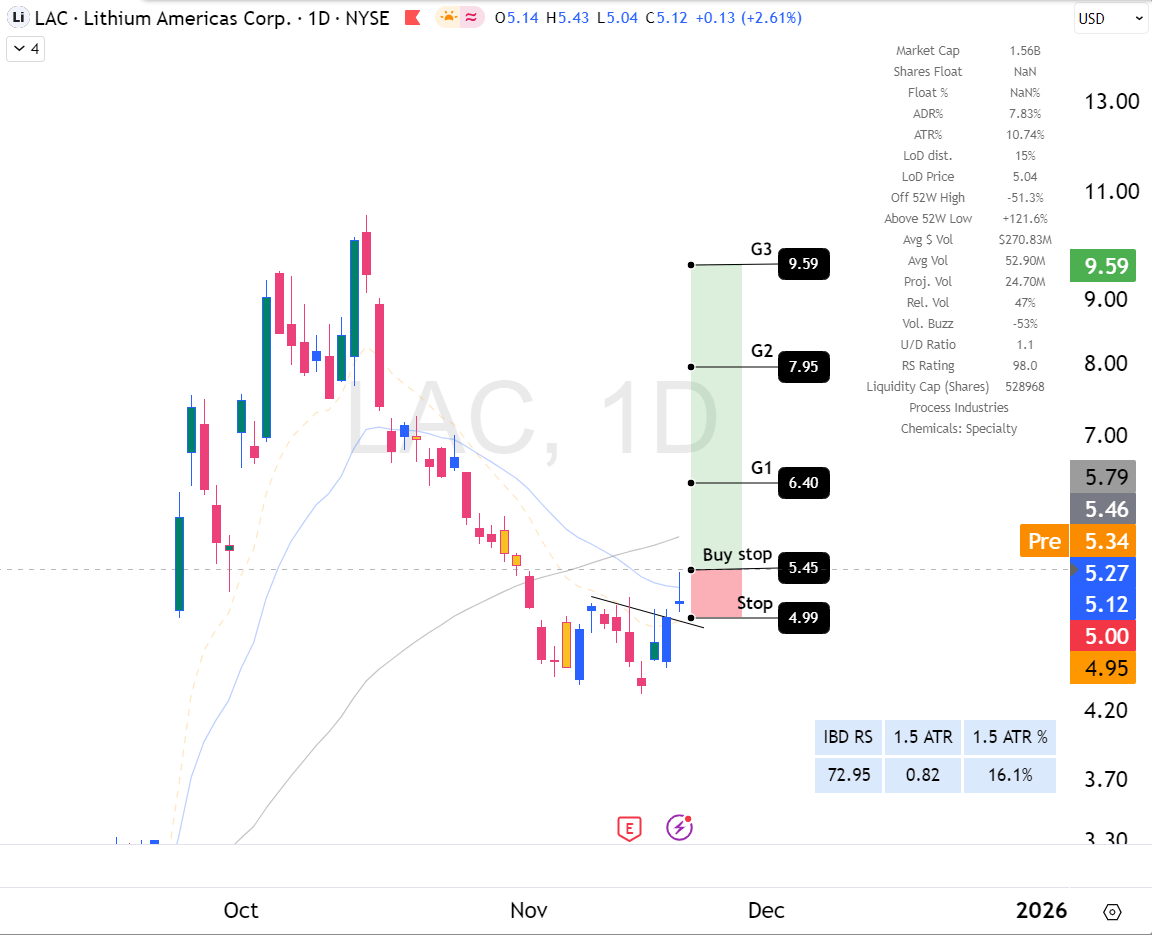

$LAC ( ▼ 2.17% ) - Swing trade

Lithium has been one of the strongest industries recently, with names like $SGML ( ▼ 8.38% ) , $LAC ( ▼ 2.17% ) , $SLI ( ▲ 2.58% ) up over 100%+ in the last few weeks.

Metals don’t follow the general market the same way tech does — which makes them a great place to find strength during market pullbacks.

LAC Daily

Subscribe to read the rest.

Get the trade alerts, education, and edge our free readers miss.

Already a paying subscriber? Sign In.

Your Premium Subscription Includes:

- • 3–10 curated stock & crypto picks each week

- • Clear Buy/Sell Rules for Maximum Profit

- • Educational breakdowns — learn while you earn

- • 70% refund if you don’t make your money back

- • Full access to our Education Hub — learn while you earn

Reply