- Profit Punch

- Posts

- The Curious Case of Copper Stocks (HBM & TGB).

The Curious Case of Copper Stocks (HBM & TGB).

My #1 Trade for 2026 isn't Gold...

Welcome back to Profit Punch.

I want to share a study on why Copper stocks might be some of the biggest gainers in the next 2-3 years.

If you are looking for where the market might go in 2026, I want to make a case for Copper. But to fully understand why I am excited about this, we first have to look at what just happened with Gold.

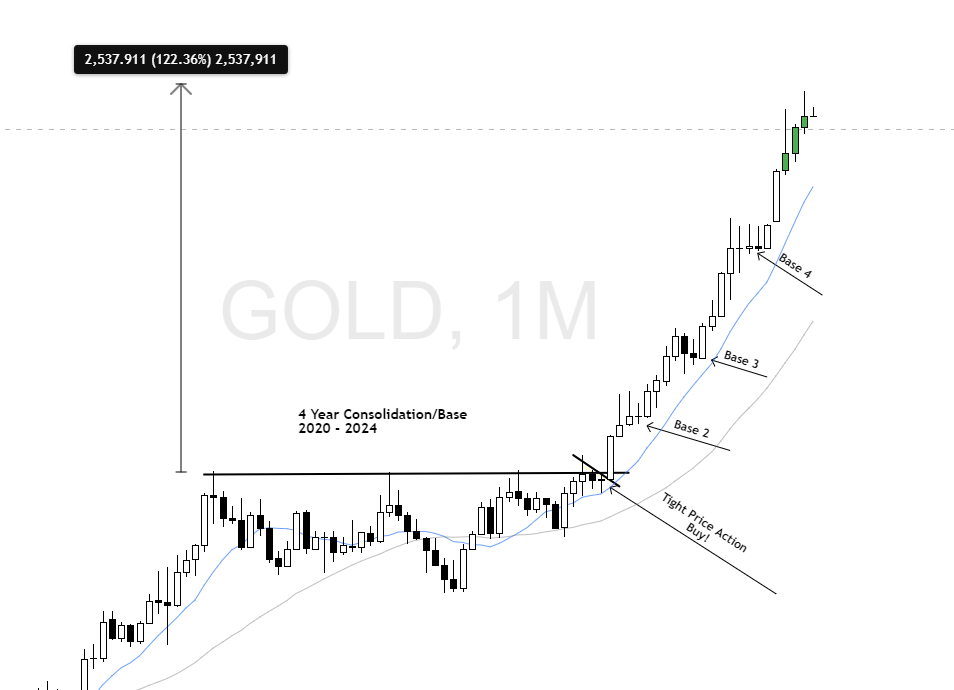

1. The Clue is in the Gold Chart

I’ve been studying the monthly chart of Gold, and one thing stands out clearly: the power of a long consolidation.

Gold Monthly Chart showing the 4-year Cup and Handle

What I’m seeing here:

The "Handle": Gold sat flat for four years. That is a long time to wait.

The Breakout: As soon as it broke that flat resistance line in 2024, it went up 122%.

It outperformed the S&P 500 and even Bitcoin. The lesson I take from this is simple: The longer the base, the longer the run. When you see a flat breakout line like that, it is usually one of the most trustworthy signals to risk capital on.

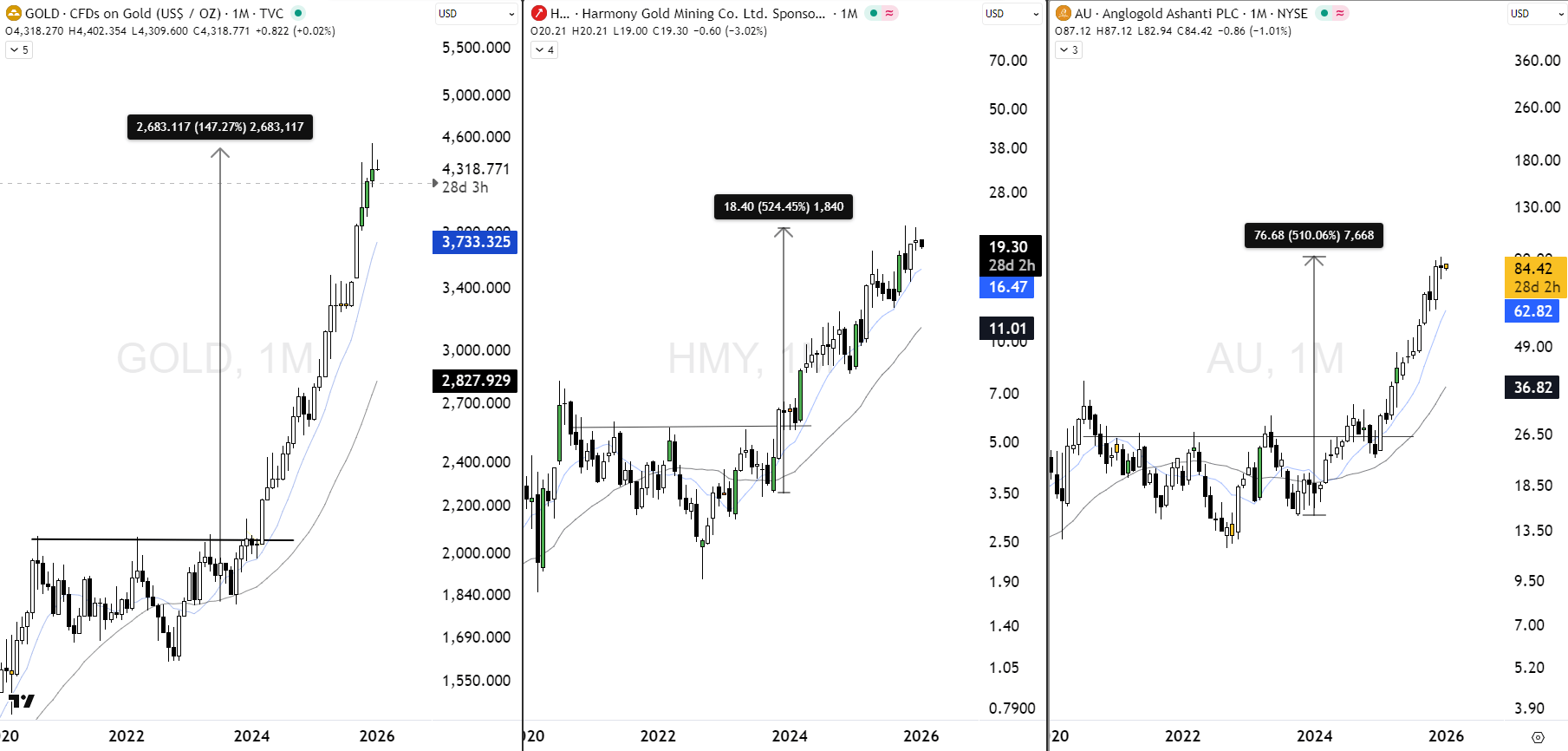

2. Why Miners Outperform the Metal

Here is the interesting part. When a commodity moves, the companies that mine it often move even faster.

Look at Gold stocks like AngloGold Ashanti ($AU) or Harmony Gold ($HMY).

Gold went up 150%.

$AU ( ▲ 0.83% ) went up 520%.

$HMY ( ▲ 0.13% ) went up 510%.

Comparison Chart of Gold Price vs. $AU ( ▲ 0.83% ) or $HMY ( ▲ 0.13% )

Once a commodity breaks out, I like to look for stocks in that sector that are showing similar breakout patterns. That brings us to Copper.

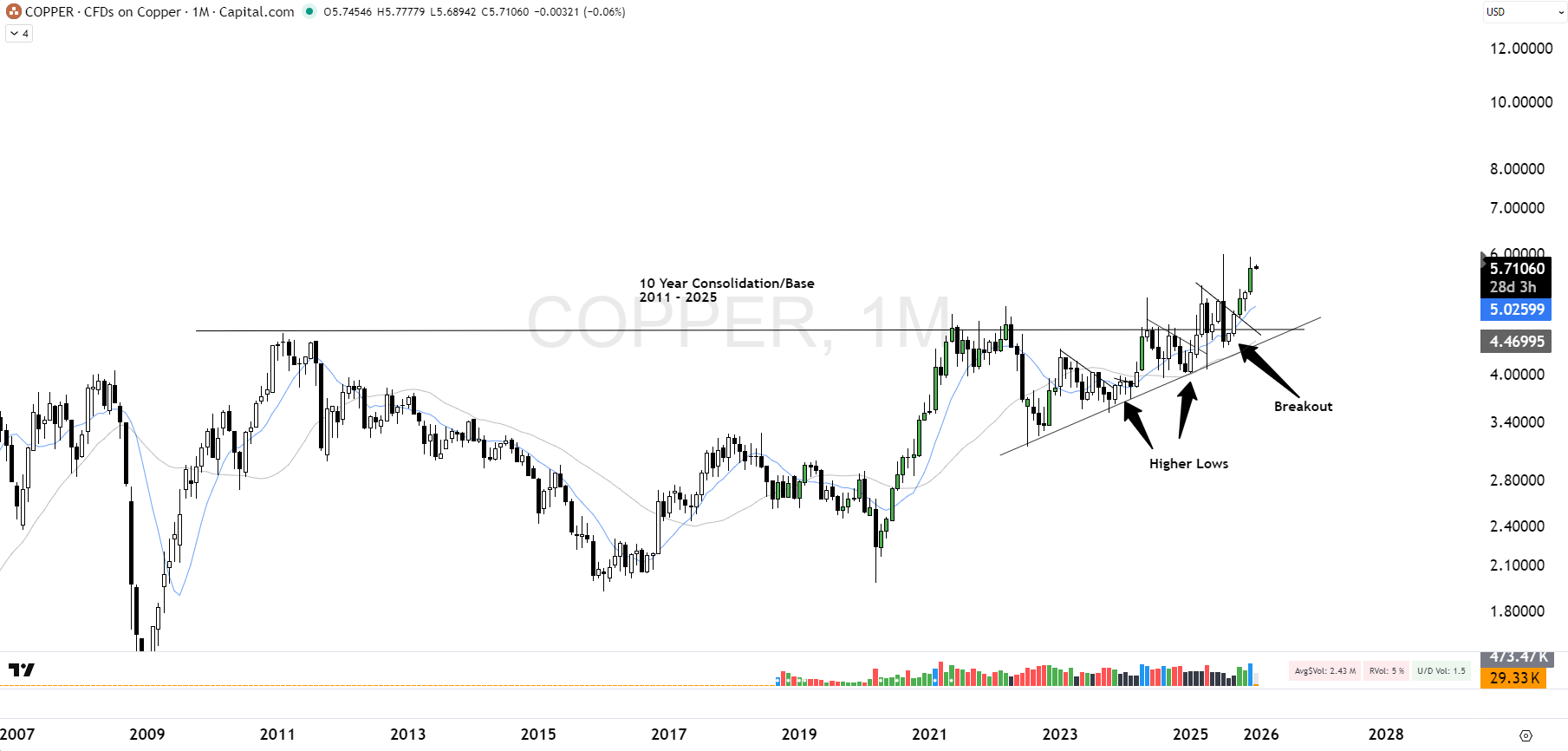

3. Is Copper Repeating History?

Take a look at the Copper monthly chart. Do you see the resemblance?

Copper Monthly Chart showing the VCP pattern

The "Vital Contraction": I’m seeing a pattern called a Vital Contraction Pattern (VCP). This is when the price swings get tighter and tighter, like a coiling spring:

The first time it dropped: ~50%

The second drop: ~30%

Then: 17%, 14%, and finally just 12%.

The selling pressure is drying up. If Copper follows the path of Gold, I don't think this move is finished.

Need Help Timing These Trades?

The charts above show you the "what," but the "when" is the hardest part. Buying at the wrong time—even on a great stock—can lead to losses.

If you want to know exactly when I am entering these positions (and more importantly, when I am selling), I share my real-time portfolio updates in Profit Punch Premium.

We are currently running a 40% OFF promotion for new members.

4. How I Plan to Participate ( $HBM ( ▼ 0.23% ), $TGB ( ▲ 2.94% ) & ETFs)

To participate in this move, there are three distinct ways to play it depending on your location and risk tolerance.

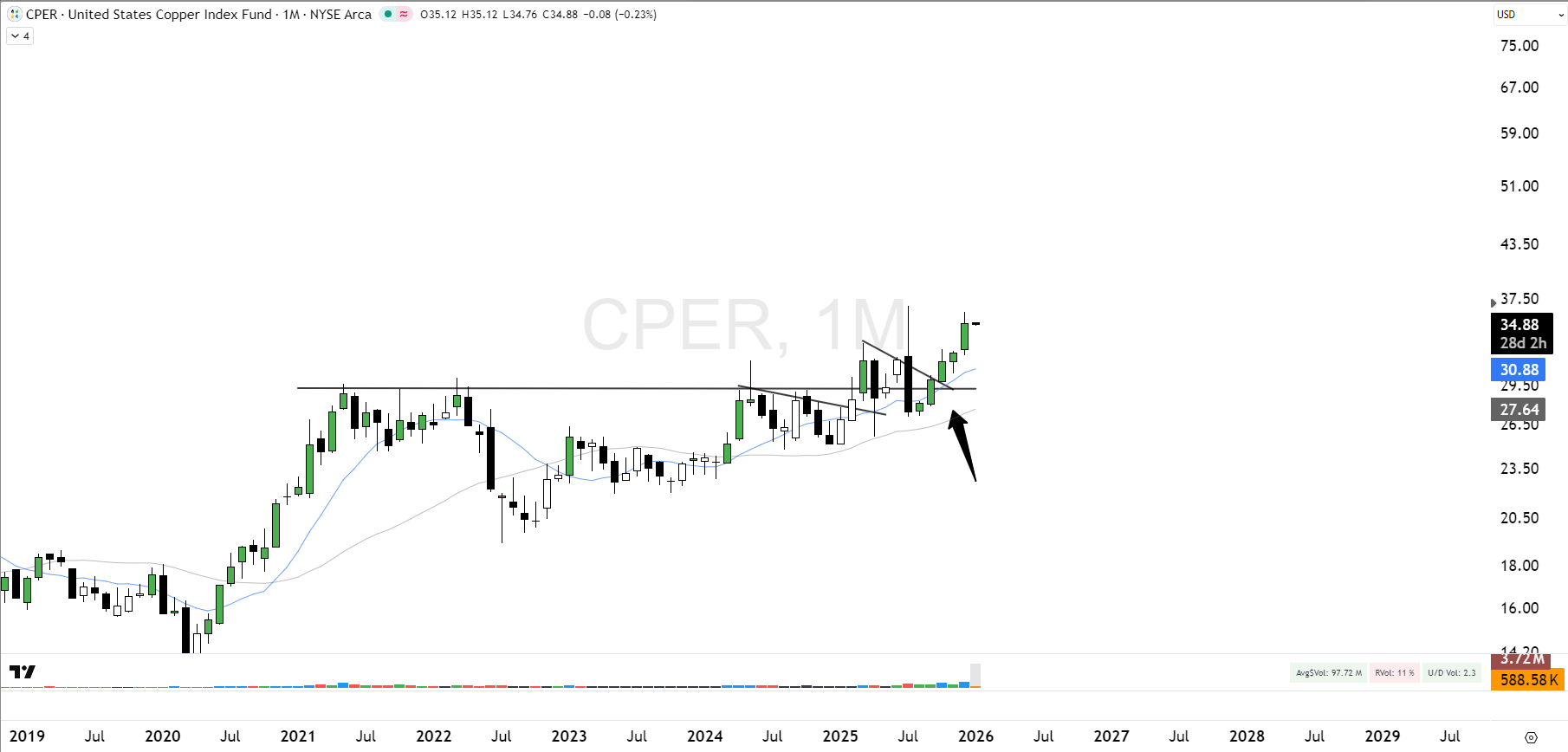

A. The Direct Play (ETF) You can use the United States Copper Index Fund ( $CPER ( ▲ 0.14% ) ).

Note: This ETF tracks the price of copper futures, not the mining stocks. It is less volatile than the miners but gives you direct exposure to the metal's breakout.

CPER : ETF of Copper Monthly

B. The Stock Play ($HBM ( ▼ 0.23% ) & $TGB ( ▲ 2.94% ) ) My top choice is to own the miners for that potential leverage effect.

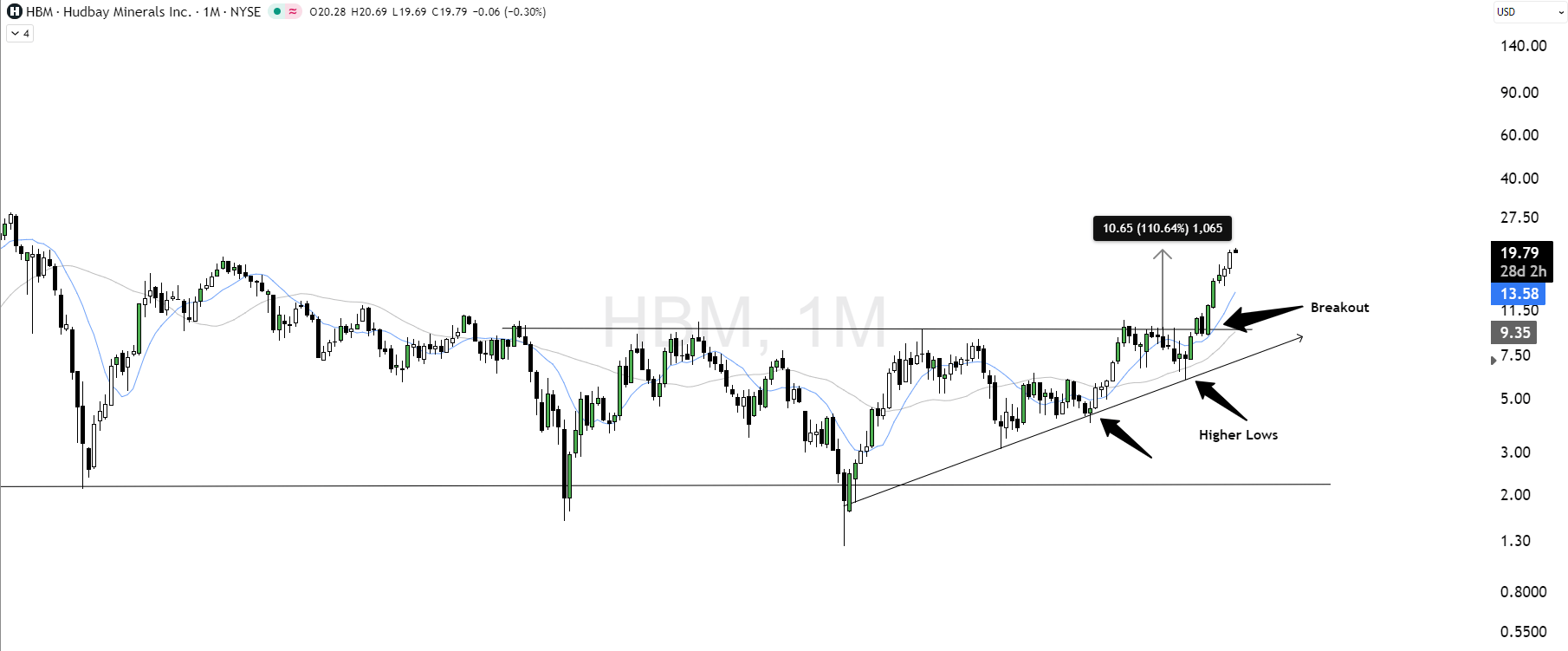

Hudbay Minerals ( $HBM ( ▼ 0.23% ) ): This is my #1 pick. It spent years building a base and making "higher lows" before finally breaking out.

$HBM ( ▼ 0.23% ) Stock Monthly Chart

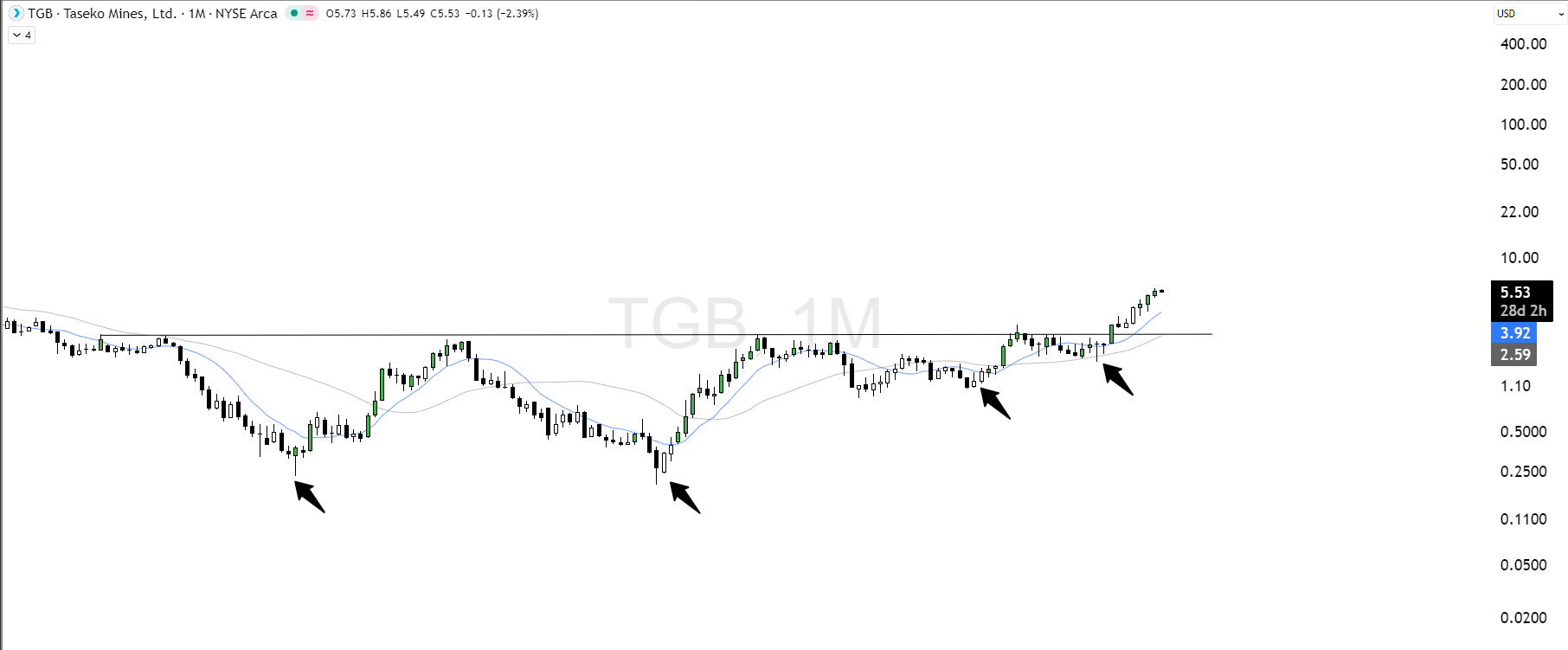

Taseko Mines ( $TGB ( ▲ 2.94% ) ): A strong alternative that has also broken out of a massive multi-year base on high volume.

$TGB ( ▲ 2.94% ) Stock Monthly Chart

C. The European Play ( $3HCL ) For my readers in Europe, you have access to WisdomTree Copper 3x Daily Leveraged ($3HCL). This is a leveraged ETF that can offer huge returns during strong trends, though it carries significantly higher risk.

Summary

We have the setup (Copper mimicking Gold), and we have the vehicles ($HBM ( ▼ 0.23% ) , $TGB ( ▲ 2.94% ) ). Now, the hard part is having the patience to wait for the right entry point.

I am personally waiting for these stocks to pull back to their 50-day Simple Moving Average before adding aggressively.

If you want to watch the full breakdown, check out the video here: [Link to YouTube Video]

May the markets be with you,

Profit Punch

Reply