- Profit Punch

- Posts

- The Pattern Behind SMCI's 240% Explosion (And How to Spot The Next One)

The Pattern Behind SMCI's 240% Explosion (And How to Spot The Next One)

Dear Profit Punch Subscriber,

In February 2024, Super Micro Computer (SMCI) exploded 240% higher after forming this simple pattern I'm about to show you. While most traders were distracted by news and noise, this pattern quietly told us exactly when to buy—before the massive move began.

But SMCI wasn't alone. The same pattern appeared in CVNA before its 200% surge and FSLR before its 62% rally. Today, I'll show you exactly how to spot it.

Why This Pattern Works

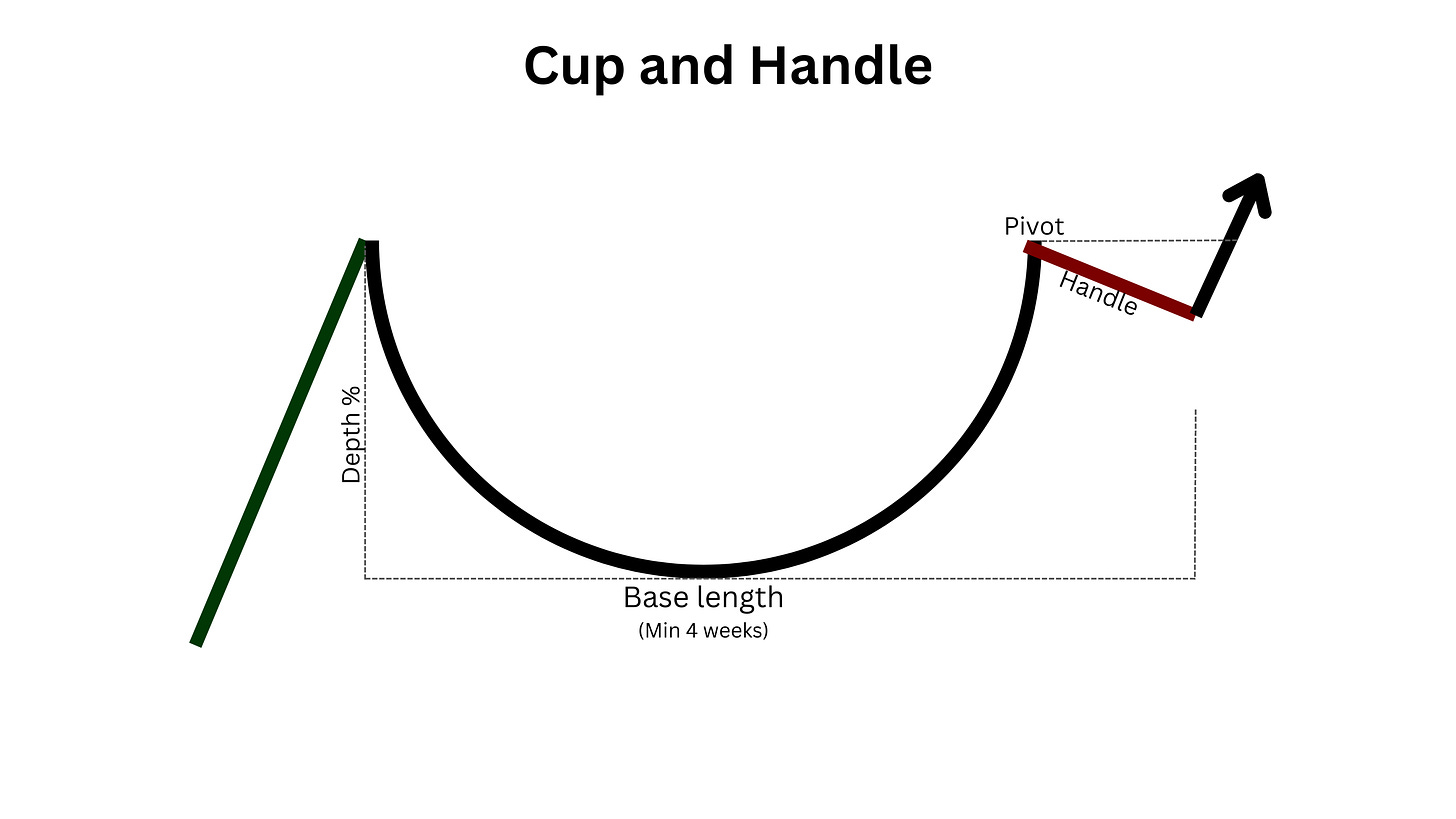

The Cup with Handle pattern works because it shows us exactly when big institutions are quietly accumulating shares. Here's what happens:

The stock pulls back as weak holders sell

Smart money starts buying, forming a "cup" shape

A final shakeout (the handle) flushes out the last weak hands

The stock explodes higher on huge volume

The Exact Pattern Rules

Here's your checklist for a perfect Cup with Handle:

✓ Minimum 4-week base formation

✓ U-shaped cup (not V-shaped)

✓ 30%+ uptrend before the base

✓ Handle drifts downward/sideways (never up)

✓ Handle correction: 8-12% maximum

✓ Decreasing volume in handle

✓ Volume surge on breakout

SMCI Case Study: The Perfect Setup

Here's exactly how SMCI played out:

Cup formed over 6 weeks from $250 to $350

Perfect U-shape with declining volume

Handle formed with 10% correction

Breakout at $375 on 73% above-average volume

Result: Stock hit $1,000 in 50 days

SMCI Split adjusted Daily

CVNA: The 200% Monster Move

8-week cup from $25 to $45

Tight 2-week handle with volume dry-up

Broke out on earnings with 92% above-average volume

Surged from $47 to $115

CVNA Daily

FSLR: The "Textbook" Trade

Classic U-shaped base

Handle showed perfect volume contraction

Buy point: $185

Stop loss: $172 (7% risk)

Target hit: $300 (62% gain)

FSLR Daily

Your Action Plan

Scan for stocks 30% off their highs

Look for U-shaped bases lasting 4+ weeks

Wait for handle with decreasing volume

Enter when price breaks above handle WITH volume

Risk maximum 7-8% below entry

First target: 20-25% above entry

Let winners run with trailing stops

Warning Signs to Avoid

❌ V-shaped bases (too sharp)

❌ Handles correcting >12%

❌ Upward-drifting handles

❌ Weak volume on breakout

❌ Less than 4 weeks of base

Next week, I'll reveal the exact pattern that preceded NVIDIA's move from $50 to all-time highs. Don't miss it!

Trading With You,

Valentine

P.S. Want these setups delivered straight to your inbox? Join Profit Punch Premium and get my exact entry/exit points every morning before the market opens.

Reply