- Profit Punch

- Posts

- This Stock Rallies 150% Every Time

This Stock Rallies 150% Every Time

The exact buy signal just flashed again.

📰 In This Issue…

The market is waking up, and capital is flowing into specific pockets of strength. We are seeing classic "Sector Rotation" where leadership is clearly defined.

Here is what we are covering in today’s Profit Punch:

The Energy Leader: Why $GEV ( ▲ 2.07% ) is showing a classic base setup and how to play the 30-week moving average.

The IPO Play: A look at $BETA ( ▲ 1.88% ) , the electric aviation newcomer that just hit the market.

Swing Trade Setups: High-volume opportunities in $VERI ( ▼ 4.06% ) , $LUMN ( ▼ 1.06% ) , $ONDS ( ▼ 0.81% ) , and a contrarian bet on South Korea ($KORU ( ▲ 4.04% ) ).

Let’s get into the charts.

🏆 Top Setups of the Day - GEV

$GEV ( ▲ 2.07% ) - Long term trade

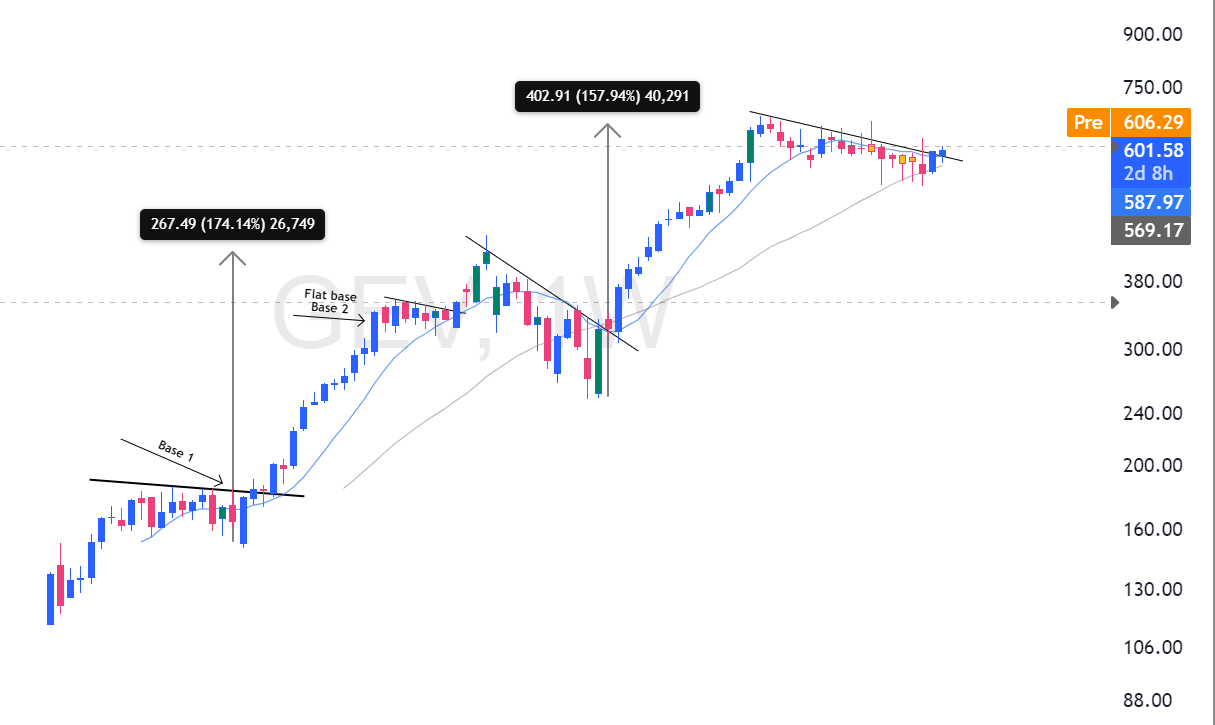

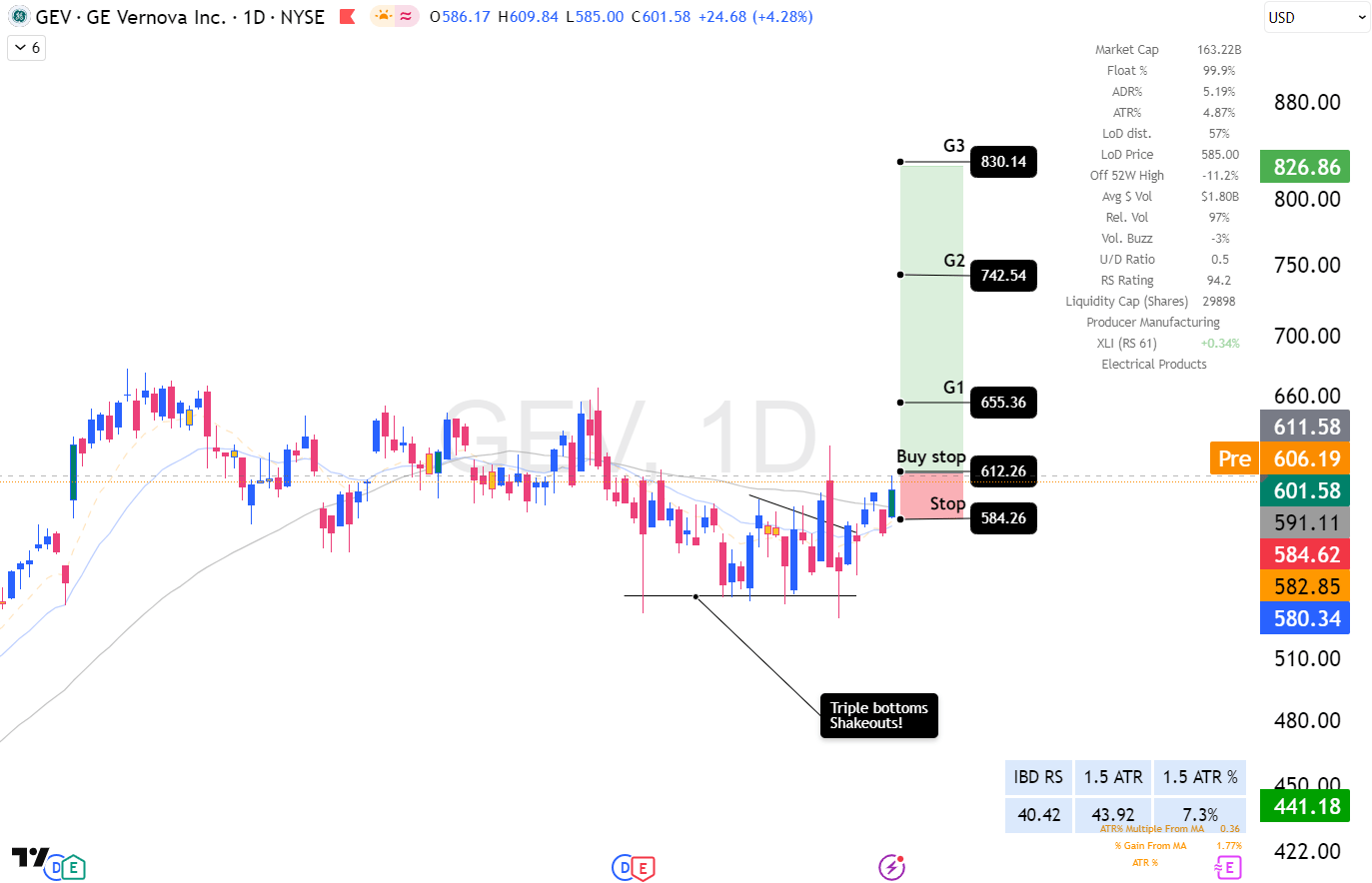

GE Vernova (Energy Infrastructure) This stock has been a beast since its spin-off. Every time $GEV ( ▲ 2.07% ) pulls back to its 30-week moving average, it has launched a massive move (historically ~150%). Will it do it again?

The Context: They just secured a massive wind contract with Taiwan Power and are investing heavily in U.S. manufacturing. The fundamental demand is there.

The Setup: What makes this base beautiful is how tight the price action is. Volatility is contracting, which often precedes an expansion (breakout).

Note: You can participate in this more profitably using the x2 ETF of the stock using $GEVX ( ▲ 3.58% )

👉 Check out its weekly chart and then check out the daily chart.

GEV Weekly Chart

GEV Daily

🔒 Below are the Rest of the Market Leaders

Subscribe to read the rest.

Get the trade alerts, education, and edge our free readers miss.

Already a paying subscriber? Sign In.

Your Premium Subscription Includes:

- • 3–10 curated stock & crypto picks each week

- • Clear Buy/Sell Rules for Maximum Profit

- • Educational breakdowns — learn while you earn

- • 70% refund if you don’t make your money back

- • Full access to our Education Hub — learn while you earn

Reply