- Profit Punch

- Posts

- Utilities Power Up on AI Demand

Utilities Power Up on AI Demand

Long-term trade Alert

The Utility sector is emerging as one of the strongest groups in the market—and AI is the reason. Artificial intelligence requires enormous energy, and that’s shining a spotlight on utility stocks.

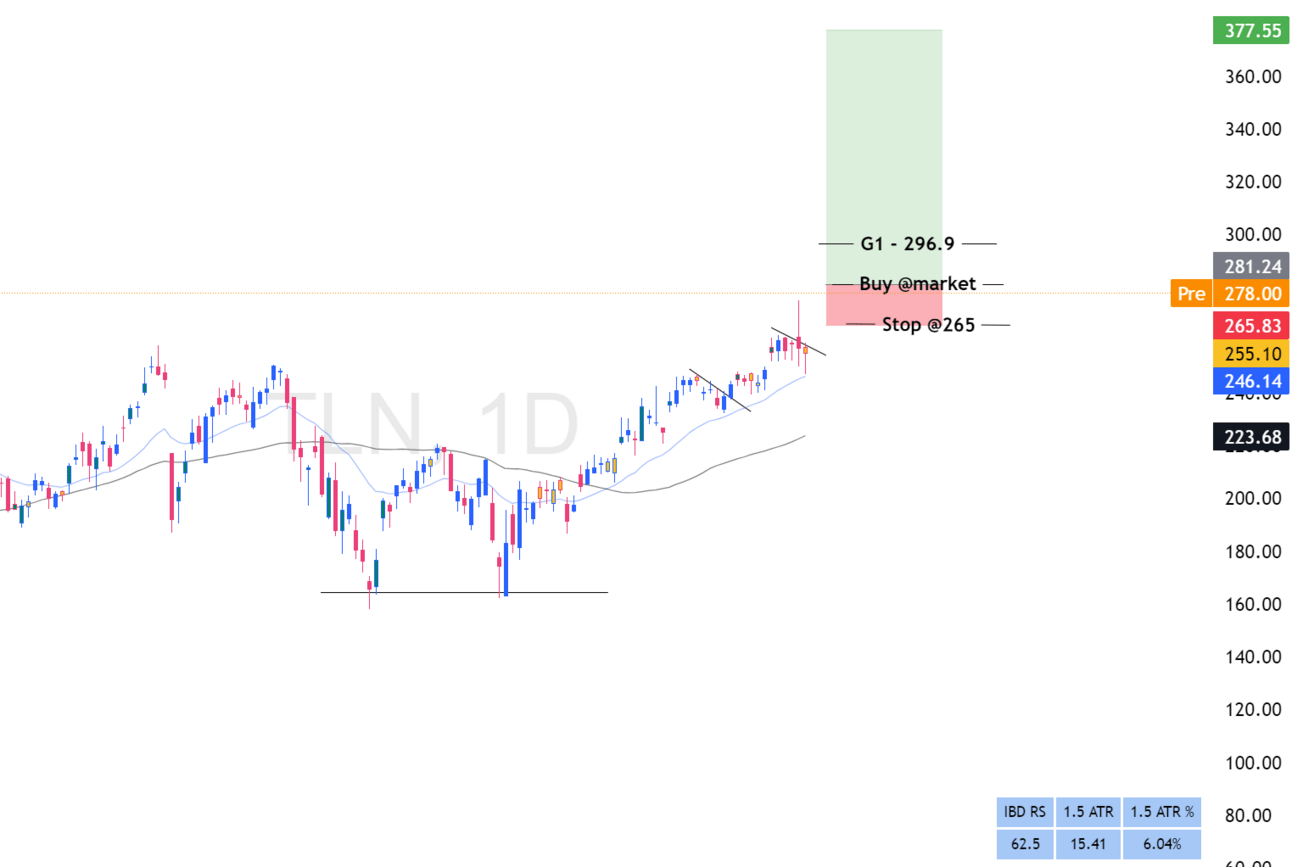

One standout is $TLN, which just announced an acquisition deal with Amazon and broke out of a massive base. This is what we call a buyable gap-up—a strong technical signal and a potential long-term winner.

If you're entering here, remember this risk management strategy:

✅ At your first profit goal, sell ¼ to ⅕ of your position.

✅ Raise your stop to your entry price or cut the risk in half.

This way, even if the stock pulls back, you protect yourself—and your profits.

TLN Stock

.

Long-Term Trade Guidelines |

These apply to investment-style trades, not short-term swings. A detailed version is available on the Resources page, but here’s a quick summary: |

What are we looking for in swing trades: ➖➖➖ Price Structures: Cheats, Double Bottoms, Breakouts, Cup and Handle, Buyable Gap-Ups, Flat/Box Bases, 150MA Bounce, VCP (Virtual Contraction Patterns), Big Bases Breakouts 🔸 Stock Selection: Leaders in strong industries, Stocks showing high relative strength, Companies with strong earnings 🔸 When to enter: Normally after a market correction or bear market! |

Risk Management(Long term trades): ➖➖➖ Risk 0.5%–1.5% of your account per trade. Never risk more than 2% of your total account on a single position. |

Exit Strategy (Simplified from the resources page): ➖➖➖ Conservative / Hands-off: Exit if the price closes below the 50 EMA. Active / Experienced: Exit on a close below the 20 EMA. |

Regards,

Valentine

Reply